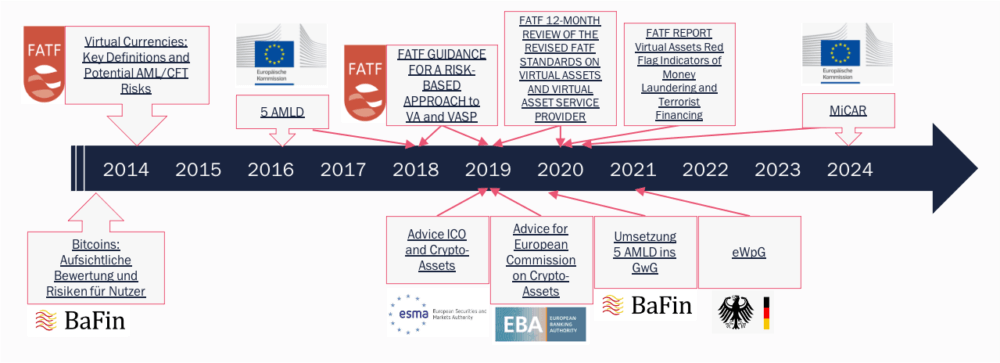

In the past, crypto assets were mostly not defined uniformly and sometimes even completely differently. A first global definitional approach took place in the context of international anti-money laundering efforts. The Financial Action Task Force (“FATF”) spoke of so-called virtual currencies at the end of 2013 when it warned of the money laundering risks of the virtual currency Bitcoin.

The German regulator, BaFin, also warned about the risks of the cryptocurrency Bitcoin in late 2013.

With the implementation of AMLD5, a definition for virtual currencies, based on the FATF definition, was created for the first time in the EU.

The German legislator also introduces a crypto asset definition for the first time and took its cue from the FATF, which expanded Virtual Currencies to Virtual Assets.

MiCAR now introduces a new crypto asset definition for the entire EEA, which differs from the German crypto asset definition.

As part of the draft eWpG, it is foreseeable that new terminology will be introduced. The crypto security (crypto securities registered on a crypto securities register) will be regulated as a special type of crypto security.

The graphic illustrates the chronology of crypto securities definition.

Click here for a PDF, in which all titles are hyperlinks and lead to the respective primary document: PayTechLaw_Infografik_Kryptowerte

Cover picture: Copyright © Adobe Stock / peterschreiber.media