Credit cards are becoming a popular method of payment in Germany. Approximately five percent of the turnover from all payments in Germany is processed via credit cards. Yet despite this, most people only have a very faint idea – if at all – of how a credit card payment works from a legal perspective. In light of this, we aim to provide some details below.

What is a credit card?

Let’s start at the very beginning: A credit card is a plastic card, which enables cashless payments at participating acceptance points. Credit cards can be used at traditional trading points as well as in the e-commerce sector. Credit cards often also include additional functions, e.g. the possibility to withdraw cash at cash machines or cash desks at credit institutions. However, this article is not about such additional functions.

Who is involved in a credit card payment?

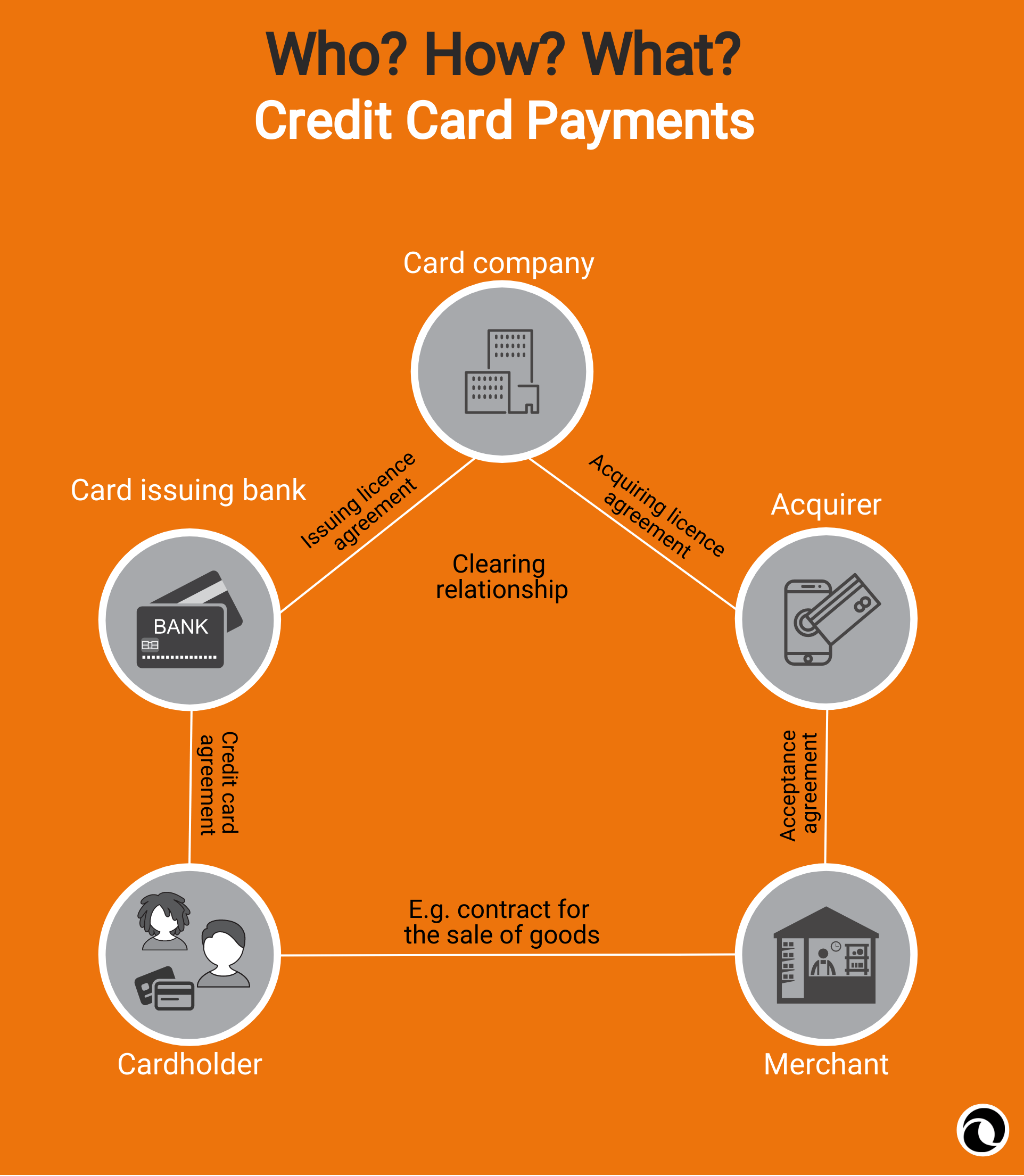

A credit card payment always involves numerous parties. For Mastercard and Visa – the most well-known credit card companies – a differentiation must be made between the following legal relationships:

- Initially, the cardholder enters into a contract with the merchant regarding the purchase of goods or services, resulting in a payable claim. For example, a customer wants to purchase a book in a book shop and pay the purchase price with their credit card.

- Between the cardholder and the card issuing bank there is a credit card agreement. The terms of the credit card contract are the result of the relevant special terms and conditions of banks for credit cards. This contract provides in particular the basis for the credit card being provided, details on how the card can be used as well as rules regarding authorisation and authentication. We will provide further details on these concepts later.

- Between the card issuing bank and the credit card company there is an issuing licence agreement, as a result of which the card issuing bank participates in the credit card system. One of the key elements of this agreement is the so-called clearing, i.e. the payment processing between the card issuing bank and the acquirer.

- Between the merchant and the so-called acquirer there is an acceptance agreement. In it, the merchant obliges the acquirer to process the card transactions submitted by it in accordance with the terms agreed upon and to settle the payment amounts underlying the card transactions.

- Between the acquirer and the credit card company on the other hand there is an acquiring licence agreement which stipulates the participation in the credit card system as an acquirer and particularly contains rules regarding the clearing.

You will find this information summarised at a glance in our infographics.

Execution of the card payment transaction

A credit card payment is generally executed in various different steps:

- By using the credit card the cardholder provides its consent to execute the card payment. This is known as the authorisation. To the extent personal security features are required for the execution of the card payment as part of the authentication, the consent is generally only provided at the point such features are being used.

- The card transaction is transmitted to the acquirer for the purposes of an approval request. The acquirer forwards this approval request to the card issuing bank or ensures that it is forwarded on. The card issuing bank can approve the card transaction or reject it, e.g. if the credit card limit is being exceeded.

- In order to ensure that the card user really is the cardholder, the card issuing bank regularly conducts a so-called authentication. The authentication is carried out based on personalised security features. These can differ depending on their respective use. For business where the customer is physically present, the authentication may be done by way of a signature or entering a PIN. If goods or services are sold at a distance, i.e. the customer is not personally present, the authentication can be done via entering the card number, validity date and the three-digit security code on the back of the card (card validation code). It may also be that the merchant and the card issuing bank have agreed that the security procedure “Mastercard SecureCode” or “Verified by Visa” are to be used.

- If the above mentioned steps have been successfully completed, , the merchant triggers the transaction via the acquirer. The card issuing bank then pays the acquirer and the acquirer pays the amount to the merchant.

Cover picture: Copyright © fotolia / chuhastock