Before I begin, I’d just like to set the scene by establishing a few things: Just as lawyers embrace their sections and paragraphs, I, for my part, love numbers (and by extension, of course, also statistics, such as the ECB payment statistics). In contrast to sections and paragraphs, they produce clear results, provided the figures are accurate. Secondly, I would like to say that the following is a true story, even though my wife claims I often like to tell tall tales.

Table of Contents

Are statistics only for laymen?

Total sales volume with payments cards that are issued in the EU by regulated payment service providers (PSPs) amounted to approximately EUR 3 trillion in the year 2017. This is the result of the payment transaction statistics of the European Central Bank (ECB). Card issuers are obligated by law to provide this data to the relevant national central bank. The central bank then passes this data on to the ECB. You can generally find the data from the respective countries on the relevant central bank’s website.

So are statistics really only something for laymen, as the aphorist Peter Rudl impudently claims? On the contrary, the individual country data plays an important role in the card business. For example, in the context of company mergers, cartel authorities base their decisions on the involved companies’ national market shares. And in M&A transactions, the value of an acquirer also depends on the development of its market share. The same applies to the salary of some sales representatives. Hence: accurate figures are of significant importance in the card industry.

Brexit and the ECB payment statistics

The British will soon leave the EU. This will not only have a significant impact on EU statistics but will also have other far-reaching consequences. Despite “only” accounting for 13% of the EU population, the UK’s 66 million residents generated over EUR 1 trillion in card payments in 2017. According to ECB statistics, this corresponds to 35% of the European turnover. In contrast to the other central banks, the Bank of England has unfortunately so far not provided any figures for 2018. This begs the question whether they don’t consider this exercise worthwhile anymore due to the impending Brexit.

To mitigate this, however, it has to be said that the heated Brexit discussions in the UK are not always based on accurate figures. It is not only Brexiteers who try to support their respective position with incorrect numbers but also those in favour of remaining in the EU. An example of this could be the allegation made in the UK press that following Brexit, British card payers would be taken to the cleaners by evil card-accepting continental merchants by having to pay up to GBP 166 million in surcharge payments (see PaySys Report Issue 9-10 (December 2018); available upon request). By the way, this figure was provided by the British government at the time…

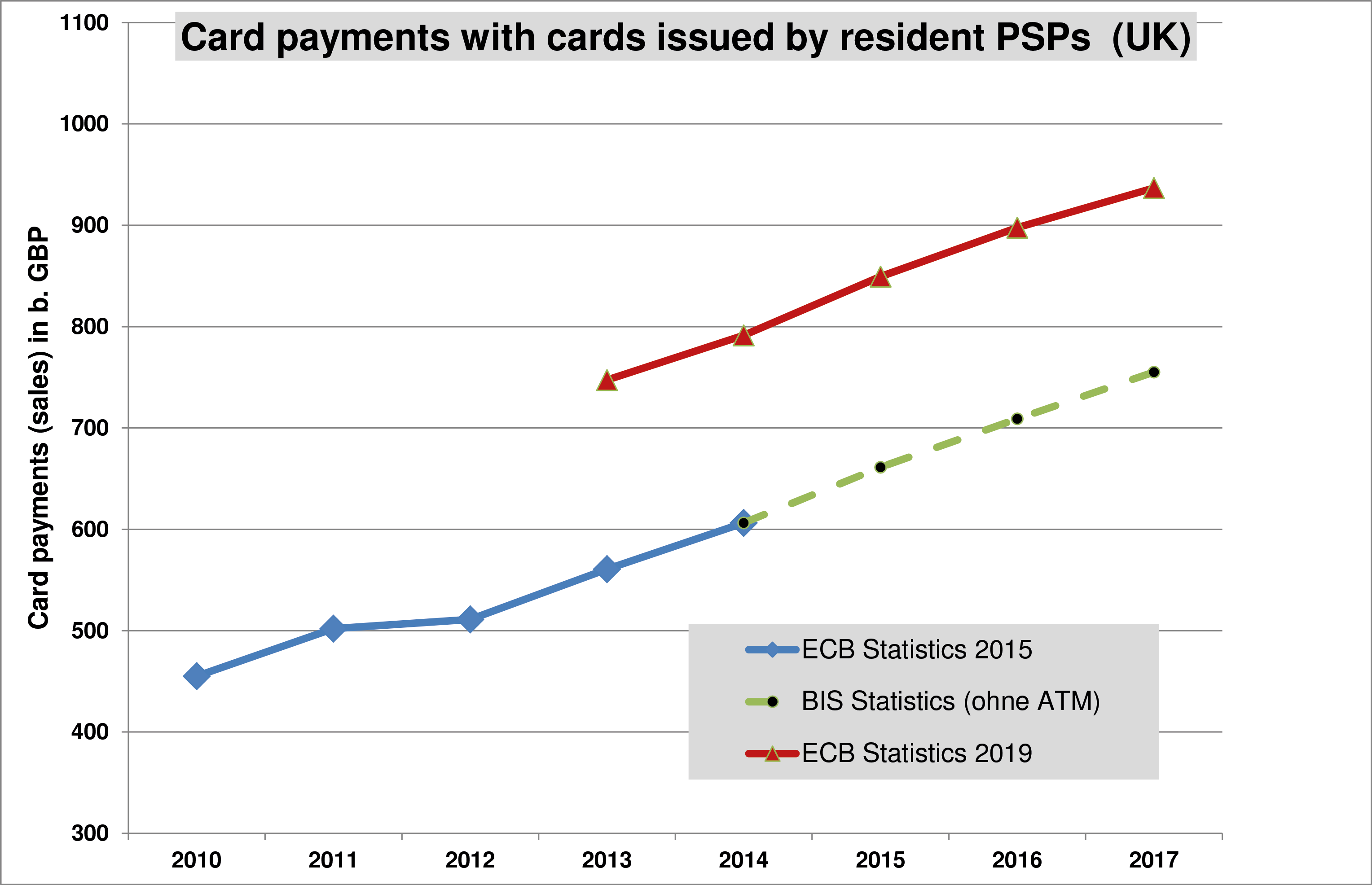

So, before this giant in card usage leaves us, let’s take a closer look at British card sales. We will focus on the sales turnover of payment cards (debit and credit cards) issued by domestic banks and other PSPs: GBP 936.8 billion or EUR 1,068.6 billion (2017). Looking at the figures from previous years in the ECB statistics, a sharp increase can be seen in the year 2014. In the 2015 statistics, the ECB reported GBP 606 billion for 2014, and today, the same statistics report GBP 791 billion for that year. (see the chart below).

Central bank statisticians regularly change their data retrospectively on the basis of new figures provided, but even in light of this, there must be something wrong if there is a jump of 30%. The explanation for this difference is actually quite simple: since 2016, the ECB has been reporting not only UK card sales under this item, but also ATM withdrawals where these cards were used. It should be noted that there is an EU Regulation (1409/2013) from the European Central Bank on payment transaction statistics. In this, as well as in other accompanying documents from the ECB, it is clearly stated what this item should contain only card payments (without ATM withdrawals).

Are statisticians blind clairvoyants?

The first conclusion is therefore quite sobering: since 2016, the ECB has been reporting false figures for the UK retrospectively for 2014 amounting to over EUR 200 billion (!) per year. This corresponds more or less to the combined card sales in Belgium and Sweden. The reported British card sales for 2017 is therefore almost 20% too high. And due to the enormous weight of this member state in this area, this means that the figure calculated for the total card sales in the EU is also about 7% off.

The bizarre thing is, is that nobody seems to notice this. The only reason I noticed the discrepancy is because I was involved in a consultancy project focusing a bit more in detail on the British card market. What is even more puzzling, is why the author of the statistics reports the correct figures to the nearly identical worldwide country payment statistics of the BIS (Bank for International Settlements). The statisticians from the Danish National Bank have made the same mistake for the years 2015 and 2016. There, card payments shot up by 24% in 2016 – also due to the incorrect inclusion of ATM withdrawals. It took some convincing, but the Danes eventually corrected the erroneous figures in the 2018 edition of the statistics retrospectively. Not as high as in the UK but still, they had previously overstated their figures to the tune of EUR 12 billion.

Dear statisticians, even if the card business is booming, such an increase in the ECB payment statistics numbers within the space of just one year should make you look again. If you collect market figures but are not that familiar with the market or the figures, it would be advisable to present the results to someone who is familiar with the matter. When Erhard Blanck (another aphorist) said statisticians were “blind clairvoyants”, he was somewhat right.

The second conclusion: you should not blindly (or with a seeing eye) trust the payment statistics from the ECB and the central banks. Who knows if it was only the Danes and the British who have been delivering incorrect figures for years? What about the other data contained in the card statistics? Have they been collected and supplied with the same diligence? If so, thanks for nothing.

Only success has multiple authors or: who is sitting in the basement like Carl Mørck?

The third conclusion: The control mechanisms (if there are any at all) fail. For the obligated card-issuing institutions, recording the figures is nothing more than an annoying legal obligation, comparable to filing my tax return on a rainy weekend. It follows that on the side of the recipients, trusting them is good but introducing controls would be better. The central banks should check the institutions’ data regarding their plausibility and not simply add them up to produce a total figure and then pass it on. A second location where the data is checked should be the ECB’s statistics department, which collects the figures from the national central banks. Moreover, at some point in this chain there should at least be one person responsible for the accuracy of these figures. In light of the 200 billion-dollar discrepancy regarding the British figures, I set out to find this person responsible. I can tell you that this was “a long and windy road”. Below you will find the abbreviated, but not at all altered in its essence, reproduction of my e-mail correspondence in this respect (June-Oct. 2019):

HG to ECB: Your card sales figures for the UK are inflated by EUR 200 billion as they include ATM turnover.

ECB to HG: We cannot comment on the accuracy of the British figures. Please contact the Bank of England (BoE) as the author of these figures.

HG to BoE: I have a question regarding your UK card sales figures that you report to the ECB. Could you tell me who I can contact about this?

BoE to HG: We don’t keep any card statistics and therefore also do not report any such figures to the ECB.

HG to ECB: The BoE told me that it is not the author for the British figures. Where does the data come from that you publish for the UK?

ECB to HG: Nonsense (or words to that effect), we always receive the UK data from the BoE.

HG to BoE: The ECB told me that you are the author of the data after all!

BoE to HG: OK, we will see if we can find the responsible department.

HG to ECB: Could you assist the BoE and tell me who sends the annual data input?

ECB to HG: The department that reports the data to us is called department “XYZ”.

HG to BoE: In order to assist you a little bit with your research: The department reporting the data to the ECB is called Department XYZ.

(Are you familiar with the author Jussi Adler-Olsen‘s crime dramas, in which Carl Mørck, head of special department Q investigates? Mørck’s small, nearly-forgotten department is located, somewhat lost, in a storage room in the basement of Copenhagen’s Police Department. This begs the question whether the basement of the historic building in Threadneedle Street that is the Bank of England is only home to gold bullion or perhaps, also something else?)

BoE to HG: The card data is collected by the trade association UK Finance (UKF) and then reported to the ECB via the BoE. For any questions regarding the data content, you can contact this trade association. Their website is …

HG to UKF: According to the BoE, the data published by the ECB is collected by you and I have a couple of questions…

UKF to HG: We do not provide this data. However, it is possible that the BoE uses our data. But this is why we cannot comment on the accuracy of the data published by the ECB. By the way, you can purchase our UK card data for GBP 3,000…

HG to BoE: The UKF tells me it is not responsible for the accurate use of their data by you and also does not let me have access to the data. Can I now please pose my question to you? Even if you use the data collected by UK Finance, in my opinion you should still be responsible for the quality and accuracy of the data, is that not correct?

BoE: OK, what is your question, please?

HG to BoE: The card sales figures reported by you to the ECB are about GBP 170 billion too high and most likely inaccurately contains cash withdrawals. Is that correct?

HG to BoE: Numerous (fortnightly) reminder e-mails

BoE to HG: We kindly ask for your understanding that we cannot answer all questions in a timely fashion. By the way, in addition to UK Finance, we also use other sources for our report to the ECB. It looks as if the data from another source indeed contained cash withdrawal figures. We will investigate this. We cannot say any more on this at this point.

Is the person liable also the person responsible?

OK, so the data provider is liable for the figures. However, the provider can often not be accessed or contacted easily by third parties. For example, for years the ECB payment statistics have been reporting around 4 million “cards on which e-money can be stored directly” for Italy.

However, the applicable legal requirements stipulate that this particular item should only include cards where the e-money balance is stored locally on the card as digital cash (e.g. on the chip) as a bearer instrument and not where it is kept in a card account on one of the card issuer’s servers. In the EU, such products have nearly completely vanished and are actually only still available in Germany (“GeldKarte”). Italy definitely does not have millions of these cards.

And we can play the same fun game again: The ECB cannot comment on this alleged error and refers to the Banca d´Italia. Their statistical department responsible for these figures refers to the person (obviously an Italian prepaid card issuer) providing these figures. Why – I was asked by the statisticians at Banca d´Italia – should this data be questioned? The responsibility lies with the respective card issuer. We simply have to believe in the data they provide. My answer that such cards have long since ceased to exist in Italy is met with indifference. The statistician is not allowed to tell me the name of the data provider. My question as to if they can tell me what the specific product is that 4 million Italians allegedly use remains unanswered. Conclusion: this data in the ECB statistics have been inaccurate for years and nobody feels responsible, neither the ECB nor the Italian Central Bank, despite the clear indication that there is a reporting error in the millions here.

So what good is an EU Regulation from the ECB regarding payment transaction statistics if nobody is interested, let alone checks, whether or not the applicable legal obligations are adhered to?

Incorrect data leads to incorrect assumptions. At least the ECB believes in the accuracy of “its” data and derives political recommendations from it, such as a few months ago, when it commented on the need for a European card-based card payment procedure. Their argument that the national card systems in the EU have lost considerable market share to the international “schemes” in recent years is based on very shaky statistical grounds, namely on their own, demonstrably inaccurate, card payment statistics.

Attention: yellow figures

My story does at least have a semi-happy ending, however. I’m glad to say I can give you some good news to put the information above into perspective. It has to be said that erroneous deviations of up to 30% from the statistical “truth” are still considered to be within an acceptable range. It could be much worse. For example, the BIS payment statistics, which is based on input from the Chinese central bank, have reported for years that the Chinese are spending around eight times (!) as much as the total Chinese gross domestic product via card and e-money payments per year (see chart). Sorry, but as an economist, I can definitely not follow this. It appears that even in surveillance capitalism, Big Data somehow does not yet lead to useful results.

P.S.: As soon as my e-mail to the People`s Bank of China has been answered, I will of course report on it – unless I end up in a re-education camp for statistical troublemakers first J.

Cover picture: Copyright © Adobe Stock /antpkr