The German Federal Ministry of Finance and the Federal Ministry of Justice recently published the draft of the Future Financing Act (Zukunftsfinanzierungsgesetz – “ZuFinG”). The primary regulatory purpose of the draft is to make Germany an attractive location for national and international companies and investors through digitalization and internationalization. Additionally, the introduction of a legal framework for crypto assets aims to establish Germany as a legally secure location for future technologies. To this end, the draft introduces the issuance of the electronic shares using distributed ledger technology.

One of the aims of the draft, and in particular the amendments to the German Stock Corporation Act (Aktiengesetz – AktG) and of the German Electronic Securities Act (Gesetz über elektronische Wertpapiere – eWpG), is to open up German law to electronic shares. Until now, the eWpG only allowed bearer bonds to be issued electronically. Once the ZuFinG comes into force, joint-stock corporations will have the option of issuing their shares either in certificated form or as electronic shares.

Table of Contents

Distinction from conventional shares

According to the ZuFinG, electronic shares can be registered in an electronic securities register instead of “classical” securitization. According to the draft, central register shares are created by registration in a central register (which is maintained by a securities clearing and deposit bank or a custodian, which (as before) has been expressly authorized by the issuer in text form). Besides, crypto shares are created by registration in a crypto securities register.

The introduction of electronic shares does not create a new type of share. According to the draft, a practical difference from conventional shares in the future could be that electronic shares will be traded on different markets or only on different platforms. The draft does not provide further details on this distinction.

Distinction between registration options

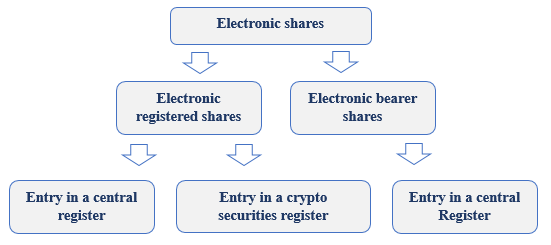

The ZuFinG distinguishes between the following registration options:

Electronic registered shares are registered in a central register or in a crypto-securities register. Electronic bearer shares will only be registered in a central register. Accordingly, crypto shares will be issued only as electronic registered shares.

The introduction of a differentiated registration regime is justified by the fact that registered shares are the dominant model for share issuance internationally. Furthermore, the authors of the draft argue that opening up German law to the issuance of bearer shares using blockchain or comparable technologies could lead to many complex problems. The authors of the draft point out that monitoring for money laundering would be much more difficult if crypto bearer shares were introduced. In addition, there could be risks arising from the anonymous communication processes, etc.

According to the draft, registered shares do not pose as many problems in terms of money laundering control, as they are not booked into intermediary-managed securities accounts. Accordingly, crypto-securities registers will only be open for registered shares.

However, such a “limited” opening of German law to blockchain and similar technology-based electronic shares may at the same time raise the question of the efficiency of the proposed regulation. Allowing the registration of bearer shares alongside registered shares would have promoted the use of the potential of distributed ledger technology and encouraged its adoption.

Issuance

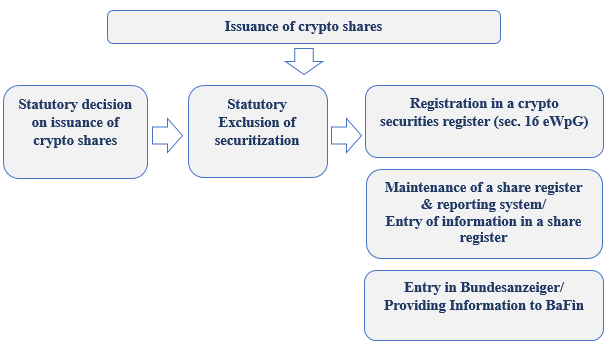

In the future, issuers will be able to issue electronic shares by registering them in a central register (sec. 12 eWpG) or in a crypto securities register (sec. 16 eWpG).

The decision to issue crypto shares must be included in the articles of association. In this case, the issuer must also exclude securitization in the articles of association. This means that if the issuer wishes to issue crypto shares, it must prepare the basis for this in the articles of association and pass a resolution to amend the articles of association at the general meeting. On the other hand, if the issuer intends to issue electronic registered shares or bearer shares registered in the central register, the issuer’s articles of association do not require such a resolution.

The draft uses technology-neutral terms such as “registered shares” and “bearer shares”. It should be noted that there is no requirement for the shareholder’s name to appear in writing on registered shares. The identity of the shareholder is disclosed by means of an entry in the register, so that the intended protective purpose is already considered to be fulfilled. There is no need for the company to be informed of the shareholder’s identity in any other way.

In the case of the electronic shares, there is no need for an (electronic) signature. According to the authors of the draft, electronic shares are already registered in a central register or in crypto securities registers maintained by means of blockchain or comparable technology, which offer the same protection against forgery as traditionally signed certificates.

In addition, registered shares with multiple voting rights will be included in the articles of association. According to the authors of the draft, this will give growth companies and start-ups more flexibility.

The eWpG introduces the detailed information to be included in the register of crypto shares. This information includes, among other things, whether the crypto shares are issued as par-value shares or no-par value shares, whether the articles of association of the joint-stock company are binding on the transfer of ownership, in the case of shares issued before full payment of the issue price, the amount of the partial payment, etc.

Furthermore, the eWpG stipulates that in the case of electronic shares, if the articles of association of the joint-stock company make the transfer of ownership subject to the consent of the company, the consent of the company is required for the transfer (“Umtragung”). Moreover, the draft provides that electronic registered shares may not be transferred by endorsement in electronic form.

In addition, the eWpG states (sec. 25 II eWpG) that the right to the security is transferred with the transfer of ownership of the electronic security pursuant to sec. 25 I eWpG. This means that the transfer of ownership requires agreement and registration (“Umtragung”) in the electronic securities register. Moreover, the rights and obligations arising from the registered shares exist vis-à-vis the company only for and against the person entered in the share register. Accordingly, registration in the electronic share register is not sufficient for the assertion of rights and obligations arising from registered shares.

Maintenance of the share register/establishment of the reporting system

When issuing registered shares (including crypto shares), the concerned joint-stock company must keep a share register in which information on the shareholder, the number of shares, the corresponding par value of the shares, etc. must be entered.

Keeping the share register does not mean that the company is automatically informed about the shareholder’s identity. The shareholder himself provides the company with the relevant information. The share register serves to provide more clarity and security.

For its purpose, the joint-stock company shall set up a reporting system. The reporting system is used to transmit the relevant information on the issue of registered electronic shares in cooperation with the entity keeping the register (the central register or the register of crypto securities).

Outlook

The introduction of electronic shares, and in particular crypto shares, into German law allows joint-stock companies to issue electronic shares (together with traditionally securitized shares) using distributed ledger technologies. If necessary, they can also freely convert shares already securitized in the traditional way into electronic shares. Joint-stock companies wishing to take advantage of the new regime can already start taking the first steps.