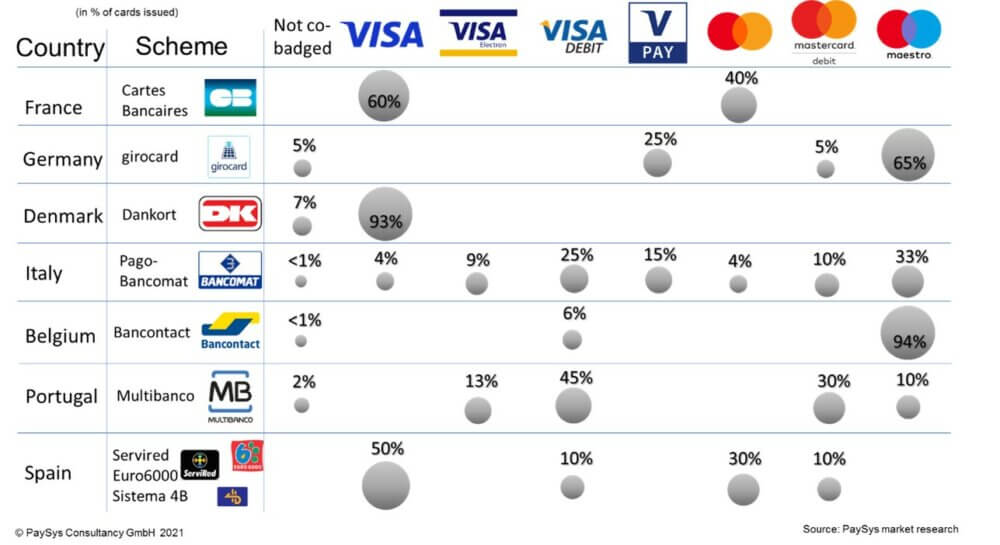

Due to Mastercard’s announcement that the debit card brand Maestro will be terminated as of mid-20231, the topic of “co-badging” of the German debit card “girocard” is currently the subject of a current discussion in the (trade) press and on relevant internet forums. Most girocard cards have another payment brand on the front or back of the card, such as Maestro (65%), V PAY (25%) and recently also “Debit Mastercard”.

These cases are “co-badging“, defined in the Interchange Fee Regulation (IF-VO) Art. 2 (31) as: “The inclusion of two or more payment brands or payment applications of the same brand on the same card-based payment instrument“. A number of legal requirements apply to co-badged cards in the EU, which are set out in Art. 8 of the IF-VO. For example, the cardholder must be given the option to select the respective payment brand for the payment (“application selection”) at the POS terminal.

In practice, this legally required option has not yet played a role at the checkout. There is currently no reason to actively opt for payment via Maestro or V PAY with the co-badged debit card in Germany. De facto, girocard is used for card payments in Germany and the second payment brand for payments abroad. This may change in the future. For example, there are already retailers in Germany that do not accept “girocard” but only the international brands. Abroad, we also see cases where the card issuer or a retailer rewards payment with a certain payment brand with bonuses. For the use of the card in e-commerce, on the other hand, the brand selection already plays a role, especially when the national brand cannot be used for card-not-present payments or can only be used to a limited extent (as was the case with the “girocard” until recently, for example).

Co-badging is primarily an issue of plastic cards or space in the purse. The problem is easily solved if each card carries only one payment brand. There are already credit institutions that issue a “naked” girocard (single-branded) and, in addition, a Mastercard or a Visa card that can be used worldwide. With virtual cards stored in an app, the issue is settled anyway. Why give a virtual card two or more payment brands. There’s enough storage in the app for multiple single-branded card apps anyway.

The co-badging issue is addressed differently in the seven major national card payment schemes within the EU. See infographic. As Visa has already announced at the beginning of 2019 that it will gradually replace its “V PAY” brand with “Visa Debit”, the brand landscape in the card business of the national card payment processes is likely to change in the direction of “Debit Mastercard” and “Visa Debit” in the near future.

At the same time, card issuers have to grapple with the issue of EPI (European Payments Initiative). The time of PowerPoint files with colorful concepts is over; now it’s about binding commitments and money on the table by the card-issuing banks. EPI is remixing the co-badging issue. Will there be a transitional phase for national card schemes where interoperability is established within Europe through a “common brand”? Will the scope of the new EPI card be limited to Europe or will it need co-badging with its rivals Visa and/or Mastercard? Find out more in our new PaySys Report No. 5 (October 2021).2

Infographic “Co-badging practices of national card schemes in the EU”

1 https://www.mastercard.com/news/europe/en/perspectives/en/2021/blog-from-valerie-nowak-why-this-maestro-is-retiring-after-30-years/

2 https://paysys.de/paysys-report/

Cover picture: Copyright © Adobe/FarknotArchitect