Do you prefer paragraphs or numbers? Both can lead to pretty contradictory results. This is a good thing as otherwise whole lines of work may be superfluous. After most of the 24 doors of our advent calendar revealed topics related to sections of legal acts, I would now like to present to you two riddles emanating from the card payment statistics of the German Federal Bank. I was unable to solve either of them, despite having some time on my hands over the festive season so I’m availing myself upon you, dear readers, to help me!

Riddle no. 1: Loss of card sales at German terminals

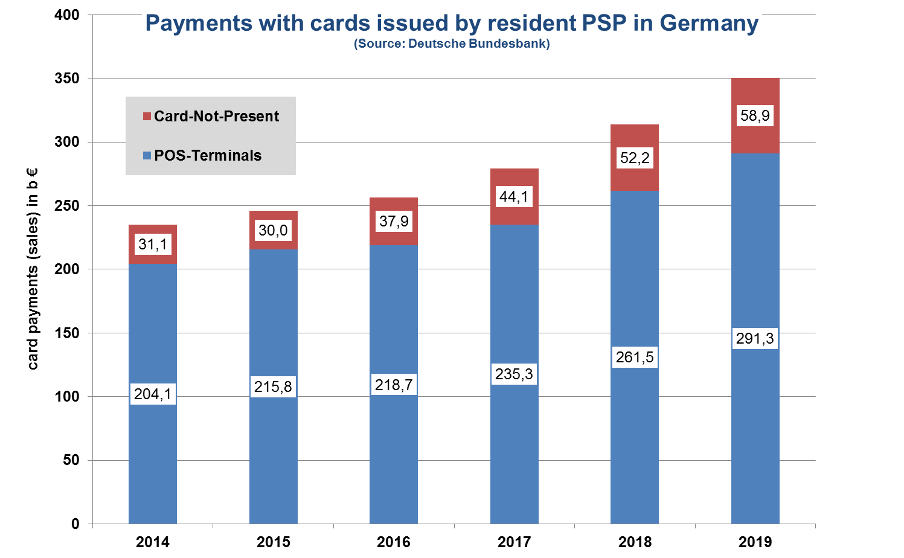

This concerns the card business. The German Central Bank inter alia collects data on card turnover from payment services providers (PSPs) who are obliged to report. All issuers and acquirers that are resident in Germany have to report their data. The Bundesbank publishes the results once a year in its payment transaction statistics.[1] The ECB then uses this data for its EU country statistics. On the issuing side, you can find sales transaction data of cards issued by German PSPs, split into domestic and abroad or acceptance (at physical POS-terminals or remote payments / card-not-present (CNP), e.g. in the area of e-commerce). You can see this split in the diagram below (data source: Table 7a).

The diagram shows continued growth and a growing share of CNP turnover (2014: 13.2 %; 2019: 16.8 %). Compared to 2018, the additional POS-sales volume (domestic and abroad) in 2019 amounted to roughly 30 billion euros. A large part of this, namely 23.6 billion euros (source: DK – Deutsche Kreditwirtschaft), was due to the debit card “girocard” (often still called ec-card).[2]Logically, the remaining 6.4 billion euros therefore have to be attributed to payments with “international” brands (Mastercard, Visa, Maestro, V PAY and Amex). So far so good as this sounds pretty logical.

It should be noted, however, that the girocard cannot be used for remote payments. Additionally, it can generally only be used at terminals in Germany (apart from some terminals in border regions as well as Germany’s 17th county that is the island of Mallorca). When using the card abroad, the second brand on the card is activated (Maestro or V PAY; both will soon be replaced with Mastercard Debit and Visa Debit by way of “co-badging”). Therefore, the entire girocard sales volume ends up at domestic terminals. This girocard turnover should show up on the acquirer side of the Bundesbank statistics (Table 7b). But oh dear, it doesn’t. Here, the domestic and foreign acquirers only report an increase of 8 billion euros in Germany in 2019 for card turnover at physical POS-terminals.

The riddle therefore is: Where is the additional girocard turnover amounting to 15.6 billion euros (23.6 minus 8)?

There are various possible explanations:

- The figure in table 7b (Bundesbank statistics) for card sales volume at POS terminals in Germany is much too low (at least 30 billion euros if in addition to the girocard all other cards are also taken into account instead of a mere increase of 8 billion euros) or the figure for 2018 was much too high.

- The DK fears that the end of the German debit card is near as a result of the announcement of a pan-European card system (key word EPI) and has therefore utterly exaggerated its girocard figures to provide it with a continued reason to exist.

- The DK’s girocard figures as well as the Bundesbank’s acquiring figures are accurate. However, in 2019 usage of other international brands at German POS massively fell and amounted to a mere 15.6 billion euros. The result of German cardholders quietly protesting the Trump Government’s policies perhaps?

- As a result of global climate change, the “Bermuda Triangle” phenomenon is no longer limited to the Caribbean.

What do you think? Are there any other possible explanations?

In this contemplative time of year, one might wonder why numbers are published where logically it is clear that one or more are inaccurate. An economist would say: “Just leave it; no data is better than completely incorrect data”. A lawyer would answer: “Yes, but there is a legal obligation to publish the reported data.” The economist would frown, take another sip of red wine and say nothing.

Let’s now turn towards the second riddle.

Riddle no. 2: Does 42 % of card turnover take place on the internet?

CNP-turnover with German cards amounts to ca. 59 billion euros. As the girocard could not yet be used on the internet in 2019, this turnover can only be attributed to cards with international brands. Compared to the total card payments volume, the CNP share amounts to 16.8% (see diagram). If you deduct the girocard turnover (2019: 211 billion euros) from the total turnover, the share amounts to ca. 42%. Therefore, according to the Bundesbank, 42% of Mastercard, Visa & Co’s turnover is generated by remote payments.

There are no reliable figures concerning the e-commerce shares of credit and debit cards. EHI retail institutions report a 10.5% share of an overall e-commerce turnover of 46 billion euros (TOP 1,000 online shops incl. Amazon). The e-commerce association BEHV estimates the entire turnover in interactive trading (goods and services) to be 94 billion euros[3] but it does not publish any current data on the share of cards. In previous years, the share reported by BEVH (ca. 15%) was always a tad higher than the EHI (ca. 10%). If we are generous and assume a share of 15% for 2019 out of a total of 94 billion euros online trading (incl. services), card turnover in the German distance selling market (incl. Amazon which is registered in Luxembourg!) amounts to ca. 14 billion euros (2019). The Bundesbank, on the other hand, reports remote payments volume of German cards generated in Germany as well as abroad of nearly 59 billion euros! There is therefore a discrepancy of 45 billion euros that are theoretically spent abroad if all figures reported to date are accurate.

There are some payment methods in e-commerce that are not just funded via direct debit and credit transfer but also via credit cards, such as PayPal and Amazon Pay. On the issuing side, this turnover appears as CNP card turnover but with merchants, it is part of PayPal & Co. If the PayPal & Co. share of the entire German distance selling market amounts to ca. 22% (estimation on the basis of the EHI figures reported for 2019), the turnover of these e-money payments amounts to ca. 21 billion euros. In this case, let’s be generous and assume a funding share of 20% via credit cards. As a result, we need to add around 4 billion euros of indirect remote card sales volume to the 14 billion direct card turnover. The discrepancy between the Bundesbank figures and the numbers reported by the distance selling merchants still amounts to 41 billion euros.

At this point I was getting desperate and so I gave this riddle to numerous experts in the card industry. It turns out that a part of the discrepancy can be explained through turnover in the travel industry, where a hotel or a rental car is prepaid with the payment card as part of an online booking or reservation. This turnover is not included by the BEVH in the 94 billion euros but the issuers include this as part of their CNP turnover. Another (albeit smaller) share of card payments volume is generated by commercial cards in the B2B area and is counted by the issuers but not by the BEVH. However, a large part appears to be distance selling with credit cards by online service providers who are registered abroad: gaming, gambling, red light business etc. This grey area is allegedly extremely active. This would mean that over 50% of the CNP turnover (at least 30 billion euros) of respectable German cardholders ends up there. And at that point in time, we were not even constantly working from home, as was the case in 2020!

Conclusion: For me, the second riddle has not been satisfactorily solved yet. Who can help? Maybe an issuer who is familiar with the card turnover of its cardholders, can spill the beans. Suffice to say, any tips will be treated confidentially.

[1] https://www.bundesbank.de/de/statistiken/banken-und-andere-finanzielle-unternehmen/zahlungsverkehr/zahlungsverkehrs-und-wertpapierabwicklungsstatistiken-804046

[2] https://www.girocard.eu/presse-mediathek/pressemitteilungen/2020/girocard-jahreszahlen-2019/

[3] https://www.bevh.org/presse/pressemitteilungen/details/vielbesteller-treiben-e-commerce-umsatz-in-2019-auf-neuen-hoechststand.html

Cover picture: Copyright © Adobe Stock / Victor Moussa