In a previous blog post, we have presented the Crowdfunding Regulation (Regulation on “European Business CrowdfundingService Providers“, (EU) 2020/1503) in terms of the authorization process (see “Crowdfunding Regulation: The licensing procedure for crowdfunding service providers“).

In this blog post we like to explore the following question:

What impact does the Crowdfunding Regulation have on the structure of a lending platform?

In a first step, we would like to illustrate the typical structure of a lending platform. Let’s use the following example, which occurs in our legal practice:

The company “Fast Loan” operates a lending platform in other European countries. Fast Loan wants to broker corporate loans from investors to German companies. The companies and the investors should find each other via a lending platform which is operated by Fast Loan. On the lending platform, the company and the investor conclude a loan agreement. Fast Loan would like to see the following structure:

For the market entry in Germany, Fast Loan turns to us and asks:

“Does this structure work in Germany from a regulatory point of view? “

And our answer is:

“Unfortunately, no.

Fast Loan has to cooperate with a fronting bank. “

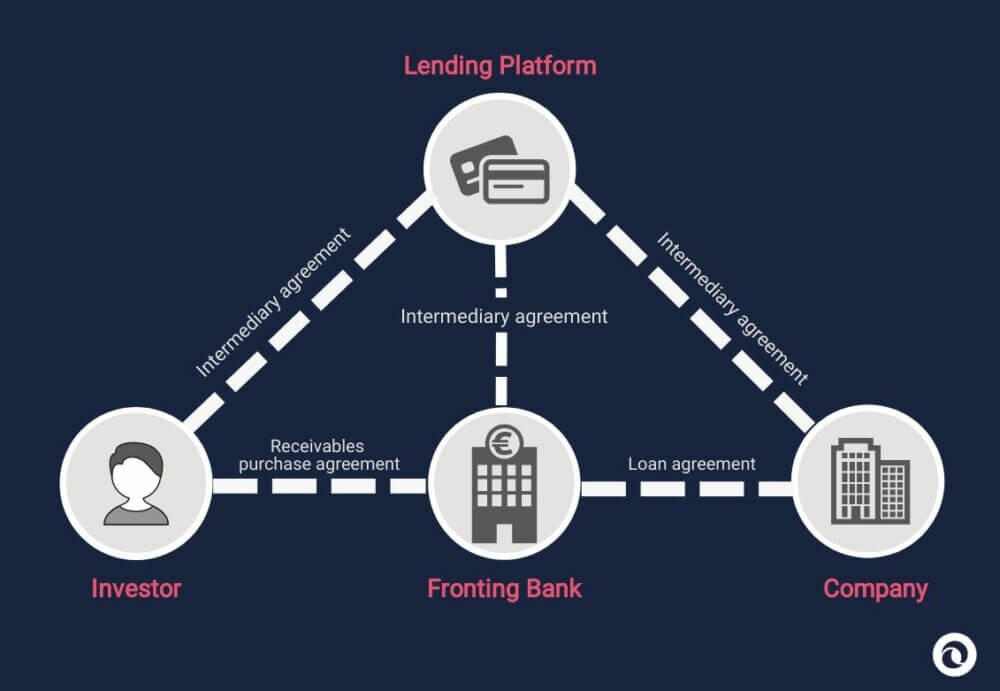

Therefore, in simplified terms, the following structure is usually applied in Germany:

The fronting bank grants the loans to the companies. Fast Loan acts as an intermediary between the company and the fronting bank. The fronting bank sells the receivables from the loans to the investors.

Why is the fronting bank needed? The granting of loans is a banking business requiring a license, strictly speaking a credit business according to § 1 para. 1 no. 2 KWG. As a rule, neither Fast Loan as a lending platform nor the investor has this permission. The fronting bank can grant loans as a bank since the fronting bank has a credit business permit. The fronting bank is remunerated accordingly for its participation and cuts a piece out of the lending platform’s margin.

What will now change due to the Crowdfunding Regulation?

The Crowdfunding Regulation introduces the following terminology:

Crowdfunding Service Provider – The Crowdfunding Service Provider provides the aggregation of business financing interests of investors and promoters through a crowdfunding platform, an intermediation of loans or instruments approved for crowdfunding purposes.1 Fast Loan provides the activity of the Crowdfunding Service Provider.

Investor – The investor is any natural or legal person that, through a crowdfunding platform, grants loans or acquires transferable securities.

Project owner – the Project Owner is any natural or legal person that seeks to fund its crowdfunding project through a crowdfunding platform. In our example, this is the company.

The Crowdfunding Regulation obliges the Member States to ensure that the Investor does not require authorization as a credit institution if he grants loans to the project promoter through the intermediary of the Crowdfunding Service Provider in accordance with the requirements of the Crowdfunding Regulation. According to the Crowdfunding Regulation, the Investor may (in particular) not finance consumers, and the financing volume for a project promoter may not exceed EUR 5 million.

The Federal Government will implement this obligation with the crowdfunding accompanying law, which is currently in the legislative process (see Bundestag-Drucksache 19/27410 (= law draft published by the German Bundestag)).

This means that the Investor can lend directly to the company and does not need permission to operate the lending business. This means that the fronting bank is no longer necessary.

Does this now mean that Fast Loan can just get going?

Not directly. The Crowdfunding Regulation restricts the obligation to obtain a permit for conducting lending business. In return, however, the Crowdfunding Regulation introduces a new authorization requirement. The activity as a Crowdfunding Service Provider now requires a permit. The requirements for this permit are also regulated in the Crowdfunding Regulation and are similar to the requirements for a permit to provide financial services or payment services.

The permission for crowdfunding service providers is an exciting alternative to structure the lending platform so that no fronting bank is necessary. Another major advantage is that the lending platform can offer the crowdfunding service across Europe. The lending platform then no longer must check the individual regulatory requirements of the respective member states and can roll out its business model in Europe.

1 The Crowdfunding Regulation also regulates investment through the issuance of financial instruments. This is not the subject of this article. The terminology’s presentation excludes this in particular.

Cover picture: Copyright © Rawpixel.com