Do the International Card Schemes (ICS) Mastercard and Visa dominate in Europe or even in Germany? Do these schemes even have a duopoly?

The answer is not simple. When talking about market dominance or duopolies, one must first define the relevant market. Are we talking about retail payments as a whole (including cash), cashless payments (including credit transfers and direct debits) or just card payments? If we focus further: Face-to-face payments at physical POS terminals or remote payments in e-commerce? Domestic payments or cross-border payments? Only C2B or also B2B and C2C? And: what do we mean by e-commerce? Including digital content, gaming and gambling? How do you define a cross-border payment? If the cardholder is domiciled in Germany and the merchant abroad, or if the issuer is domiciled in Germany and the acquirer abroad? (By the way, not even the EU legislators have managed to define this term consistently and without contradiction in PSD2 and IFR). The delineation of the respective market is important because in my residential street I am probably a monopolist as a payment nerd.

In any event, the answer to the above question is different each time. The thesis of a dominant market position (market share of at least 90%) of the two ICS is correct if one limits the card market geographically to e. g. the UK. Or one focuses on the market for “cross-border card payments by cardholders resident in member state A to merchants resident in country B”. If e-commerce is added here, the dominance becomes questionable again.

The thesis of a general dominance of ICS in the European card market has become a common narrative that apparently no longer needs to be questioned.

A number of banks in the EU are currently planning to establish a European card payment procedure as part of the EPI (European Payments Initiative), mainly for geopolitical reasons of self-sufficiency. The ICS dominance thesis is an important additional argument here. This initiative even received government support from seven member states on November 9, including Germany, represented by the Ministry of Finance1. Here, too, the narrative resurfaced:

“At the same time, the EU market remains largely dependent on solutions offered by non-European actors, both at points of sale and online.”

It is only one example among many. “Der Spiegel” took it to the extreme in its article “Die neuen Sittenwächter” (No. 43 of 23 October 2021). The article is about the unwillingness of Mastercard and Visa to use their payment systems to process payments between participants on certain (legal) platforms in the so-called adult segment. The thrust of the article: The two schemes would impose their morality on others through market power. Now I don’t want to discuss here the apparently different moral concepts between Mastercard or Visa on the one hand and the many other offered internet payment providers (bank transfer, Klarna, iDEAL, PaySafe, PayPal, mobile billing up to gift cards) in the disreputable depths of the internet (adult, gambling etc.). There is no question of a duopoly of the Mastercard and Visa schemes in this market segment.

To prove the market power of ICS, the magazine did research. A graphic entitled “The Card Duopoly” appears with the article, showing the “Market Shares of the Major Credit Card Companies in Europe 2020, in Percentage“. Visa has 58%, Mastercard 41%. The source cited is the American magazine Nilson Report, a reputable source in the card industry. Based on these figures (99% for both players), the term “duopoly” seems appropriate.

The text continues: “In fact, Visa and Mastercard form something of a duopoly in the credit and debit card market. In both Germany and the US, the two processes almost nine out of ten of these payments. For online platforms, credit card payments are almost without alternative. ” (Der Spiegel, Nr. 43 from 23.10.21, p 81, translated by the author).

What do you do in these days of rampant false reports and “fake news”? Exactly: a fact check.

First, the authors get confused in their use of the terms credit card and debit card. The data in the Nilson Report source refers to “global brand cards”, i.e. debit and credit cards of the Mastercard, Visa, Amex and Diners Club brands. The authors make it “credit cards”, although again the text refers to both card types (“credit and debit card market”). As for online platforms, again they only refer to “credit cards”. I don’t know of any online platforms In Germany that accept only credit cards, but not debit cards from, say, Visa. By the way, about 70% of Visa cards issued in Europe are debit cards. You could still get away with that inaccuracy.

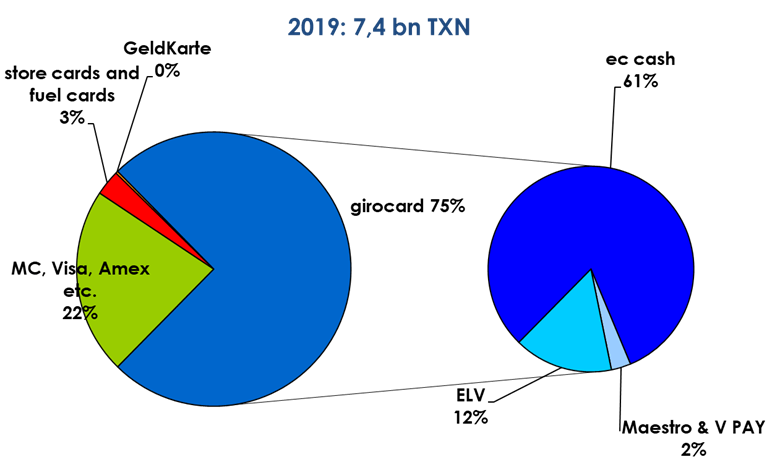

More serious is the neglect of debit and credit cards issued by national card schemes in Europe, such as the “girocard” in Germany, “Carte Bancaire” in France, etc. The Nilson chart refers only to the market shares (on a transaction basis) of the cards with the international brands. However, the text is about the credit and debit card market in Germany and in the US. In the German card market, ICS have a market share of only 24% in 2019 (based on transactions at merchants in Germany). See chart. The statement “in both Germany and the US, they process almost nine out of ten of these payments” may be true for the US, but definitely not for Germany. Furthermore, the duopoly (of ICS) with reference to Europe from the Nilson source cannot be used as a source for market conditions in a particular country in Europe (here Germany) as the Spiegel article suggests. The graph is out of place and leads to erroneous interpretations.

The last statement “for online platforms, credit card payment is almost without alternative” is also wrong, even if one would tacitly include the debit card. On Amazon.de, the largest online platform in Germany, most payments are made by direct debit.

Source: PaySys Card Market Statistics Germany 2010-2019, p. 20

So what about the much-vaunted market dominance or even duopoly of ICS in the European card market?

In the EU (27), there are seven major domestic card schemes (BE, DE, DK, ES, FR, IT, PT) and some smaller ones (e.g. Bulgaria). With 49% market share in 2019 (in terms of card payment turnover of cards issued in the EU by domestic payment service providers), the seven major European schemes successfully compete with the “American” schemes. With ten players (including Amex) in a competitive market where none exceeds 35% market share, the term duopoly is far from accurate.

In the EU card business, the pandemic-related lockdowns had a completely different impact on sales of debit cards (+4%) and credit cards (-13%). This is not surprising as credit cards continue to be preferred in the travel & entertainment segment. Since most national schemes only issue debit cards, these schemes have a slightly higher market share in total for 2020, according to calculations. As a result, the ICSs are also losing their previously narrow majority in the EU-27 in mathematical terms. For a detailed analysis of card scheme market shares in the EU, see our new PaySys Report (10/2021).

Linguistically and mathematically, there is currently no dominance of the “American” or “non-European” schemes in the EU card market. There may only be a dominance or duopoly in individual member states without domestic card schemes.

That was the fact check.

Narratives can become entrenched through constant colportage and thus survive for a long time as “established knowledge.” Remember the spinach myth as an iron bomb? At “Der Spiegel” I tried unsuccessfully to break the chain by pointing out the error. But they see no need for a subsequent correction. Everything was correct. This is how false reports are created.

1 https://www.bundesfinanzministerium.de/Content/DE/Pressemitteilungen/Finanzpolitik/2021/11/2021-11-09-joint-statement-epi.html

Topic related articles

Infografik Co-Badging der nationalen Kartenverfahren in der EU

Cover picture: Copyright © Adobe Stock / eyewave