The European Securities and Market Authority (ESMA) has recently published final report on the DLT Pilot Regime (DLTR). The report includes the Guidelines for operating DLT market infrastructure (DLT MI) under the upcoming DLTR. The provided Guidelines cover standardized templates and forms to be used by applicants to apply for specific permission under DLTR. The Guidelines will apply from 23 March 2023.

Table of Contents

1. Purpose of the Guidelines

The published set of Guidelines aim to set up uniform forms, formats and templates for market participants to apply for permissions to operate DLT MIs. Specifically, if applicants want to operate as a DLT Multilateral Trading Facilities (DLT MTF), DLT trading and Settlement Systems (DLT TSS) and DLT Settlement Systems (DLT SS), they are encouraged to follow the provided Guidelines. The competent national authorities should also make every effort to follow the published Guidelines. These will lead to the establishment of the consistent and efficient supervisory practice.

2. Compliance and reporting obligations

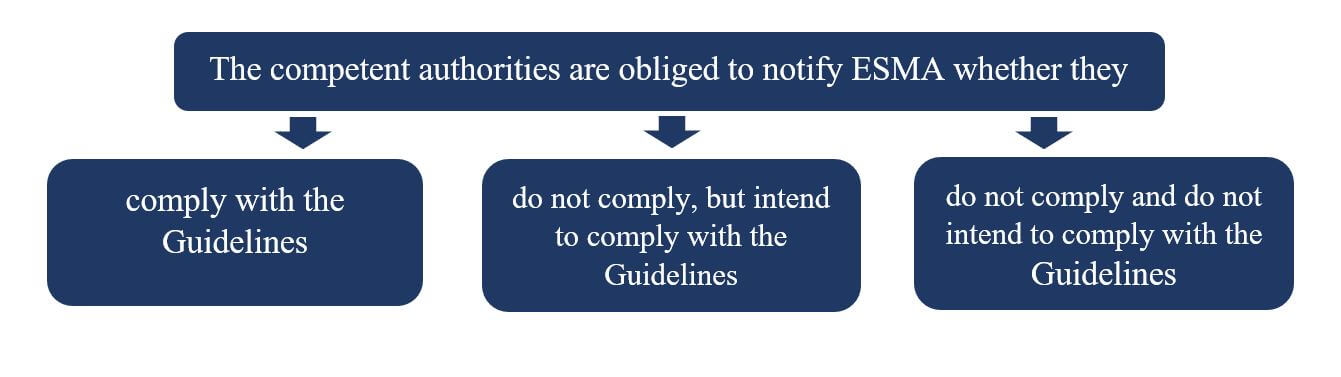

According to the published final report, competent authorities (to which the provided Guidelines apply) should incorporate the Guidelines into their national legal and/or supervisory frameworks.

The mentioned reporting requirements should be fulfilled within two months of the date of the publication of the ESMA’s Guidelines (in all EU official languages). The competent authorities, that don’t intend to follow the Guidelines should notify ESMA about their reasons for not complying (within two months of the date of the publication of the Guidelines).

On the other hand, financial market participants are not obliged to fulfil ESMA-reporting requirement on their compliance with the published Guidelines.

3. Instructions for competent authorities

Instructions for submitting an application for a specific permission to operate a DLT MI, should be published on the website of the competent authority. Particularly, the competent authorities should provide on their website the information that duly completed application forms/notifications/any related additional information are to be submitted using durable medium.

Additionally, they should indicate whether information should be submitted on paper/electronically/using both formats. Moreover, the competent authority should specify the template-filling language on their official websites. The details about the contact point for handling all applicants’ information should also be published on the competent authorities’ website.

4. Submission of application to the competent authority

According to the ESMA-Guidelines all applicants that aim to receive a specific permission to operate a DLT MI, are obliged to provide the competent authority with

- general information on the applicant (Table 1 of the Annex)

- general information for permission to operate a DLT MTF, a DLT SS or a DLT TSS (Table 2 of the Annex).

a. General information on the applicant

General information on the applicant should include the following data:

| Date of application | ISO 8601 date in the format YYYY-MM-DD |

| Identification of the applicant | Corporate name, legal entity identifier, segment MIC (applicable for DLT MTFs or DLT TSS), registered address of the applicant, contact details of the person at the applicant responsible for the application, etc. |

| Identification of the application | Nature of the application; where already obtained by the applicant, authorisation under Directive 2014/65/EU or Regulation (EU) 909/2014; trading venue(s) or SSS the applicant operates or intends to operate (where applicable); simultaneous application under Directive 2014/65/EU or Regulation (EU) 909/2014, etc. |

| Legal status of the applicant | The memorandum and articles of association/other constitutional and statutory documentation; an excerpt from the relevant commercial or court register, or other forms of certified evidence of the legal address/business activity of the applicant; a copy of the decision of the management body regarding the application/the minutes of the meeting in which the management body approved the application file/its submission, etc. |

b. Information that should be included in an application for permission to operate a DLT MTF, a DLT SS or a DLT TSS

The Table 2 of the Annex of the provided Guidelines lists the main information that should be included in an application for a specific permission to operate a DLT MI. Namely:

The business plan of the applicant/the rules of the DLT MI/any legal terms as referred to in Article 7 (1) of Regulation (EU) 222/858: description how the applicant intends to carry out planned services/activities; description of the critical staff (IT, internal control, risk management); type of clients targeted; description of the technical aspects; description of the use of the DLT; rules defining the rights, obligations, responsibilities and liabilities of the operator of the DLT MI, as well as that of the members, participants, issuers and/or clients using the concerned DLT MI; criteria for participation; governing law; the pre-litigation dispute settlement mechanism; any insolvency protection measures under Directive 98/26/EC; the jurisdiction for bringing legal action, etc.;

Information regarding the functioning, services and activities of the DLT MI as referred to in Article 7(3) of Regulation (EU) 2022/858: type of DLT Financial Instruments traded and or/settled; type of DLT used; “description of how the operators carry out their functions, services and activities; description of services provided to clients; description of how the performance of those functions, services and activities deviates from those performed by a multilateral trading facility or a securities settlement system that is not based on DLT”, etc.;

Information on the functioning of the DLT used, as referred to in Article 7(2) of Regulation (EU) 2022/858: information on the rules on the functioning/accessing DLT used/participation of the validating node(s)/validation process of transactions on DLT FI/rules addressing or detecting potential conflicts of interests/rules on risk management, etc.

Overall IT and cyber arrangements as referred to in Article 7 (4) of Regulation (EU) 2022/858:

- Governance and strategy – internal control/governance arrangements for IT and information security risks/strategy;

- IT and information security risk management – policies/procedures for identification/management of any IT/information security risks caused by the use of DLT/DLT financial instruments;

- Information security arrangements and controls;

- System development Life Cycle (SDLC), IT project and change management – appropriate policies/procedures/governance/control arrangements;

- Business Continuity management – appropriate policies and procedures;

- Third party risk management – appropriate policies and procedures, etc.;

Additionally, application should include description of (safekeeping/segregation) arrangements to record and protect members’, participants’, issuers’ or clients’ funds, collateral or DLT financial instruments in accordance with Article 7(5) of Regulation (EU) 2022/858, description of the investor protection measures as referred to in Article 7(6) of Regulation (EU) 2022/858 and transition strategy.

c. Overview of the templates for the applicants DLT MIs to apply for limited exemptions from specific requirements of MiFIR/MiFID II or CSDR

Besides, the published Guidelines include templates for the applicants DLT MIs to apply for limited exemptions from specific requirements under MiFIR/MiFID II or CSDR. Specifically, Table 3 and 4 of the Guidelines lists the details that should be included in the request for the mentioned exemptions.

More specifically, the application for a specific permission for operating DLT MTF/DLT TSS should include

- information on the requested exemptions;

- the justification for each exemption requested;

- any compensatory measures proposed and the means by which it intends to comply with the conditions.

Additionally, according to the Table 3 of the Guidelines, the applicant is obliged to provide the following information to the NCAs:

- Information that the exemption is proportionate/justified by the use of the distributed ledger technology;

- Information that the exemption is limited to the DLT MTF and does not extend to any other MTF operated by the applicant;

- Unique reference number of the document, Title, Chapter or section or page where the information is provided or reason why the information is not provided.

The application for permission to operate a DLT SS/DLT TSS should also include information on the exemptions requested, the justification for each exemption, compensatory measures and the means by which it intends to comply with the conditions (Table 4 of the Guidelines). Additionally, applicants are obliged to demonstrate that the exemption is proportionate to, and justified by the use of the DLT and limited to the DLT SS.

If the applicant is already authorised or plans to be authorised as an investment firm or intends to operate a regulated market under Directive 2014/65/EU and plans to operate a DLT MTF or DLT SS, it should follow the instructions provided in the Table 3 and 4 of the Guidelines. If the applicant intends to be authorised as a CSD under Regulation (EU) No 909/2014 and plans to operate a DLT SS or a DLT TSS, it should follow the instructions of the Table 4 of the Guidelines.

5. Outlook

The published Guidelines provide detailed instructions to market participants and to NCAs for application process under the DLTR. Even though that these Guidelines don’t have mandatory nature, ESMA strongly encourages applicants and NCAs to follow the provided instructions and in this way promotes consistent supervisory practice.

Topic-related posts

Cover picture: Copyright © Adobe Stock/Konstantin Yuganov