The following article provides an overview of the requirements that factoring companies have to meet with regard to anti-money laundering law. In order to meet the requirements, it is necessary to visualise the typical constellation in factoring.

Table of Contents

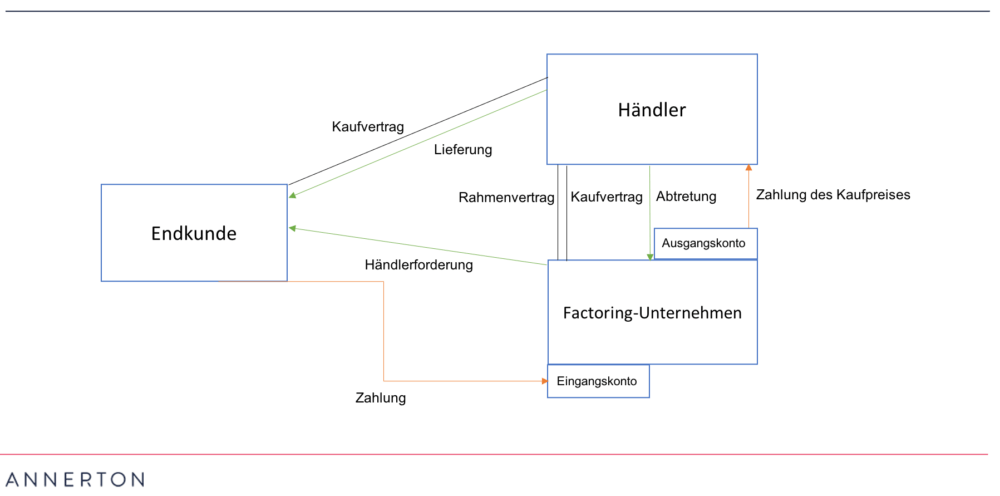

For the purposes of this article, we will use the following typical constellation as a starting point:

There is a legal relationship (Valuta-Verhältnis) between the merchant and its end customer, usually a purchase agreement. The merchant provides his service according to the purchase agreement; e.g. he delivers the goods to the end customer and in return receives a receivables against the end customer for payment of a purchase price (hereinafter the “Merchant Receivable“). The factoring company concludes a framework agreement (Rahmenvertrag) with the merchant in which the factoring company is obligated to purchase merchant receivables on an ongoing basis. The merchant assigns the merchant receivables to the factoring company, and the factoring company pays a purchase price to the merchant in return. The factoring company thus becomes the creditor of the end customer, and the factoring company collects the Merchant Receivables from the end customer.

Types of factoring

In factoring, a distinction is made under civil law between non-recourse (echtes) and recourse (unechtes) factoring. In the case of non-recourse factoring, the factoring company buys the receivables from the customer and thus assumes the default risk. This is classified as a purchase of rights under civil law. In contrast, the term “recourse factoring” is used when the factoring company buys the receivable but does not assume the default risk of the end customer, since the factoring company can transfer the receivable back to the customer. This is classified as a loan agreement under civil law.

For this article, however, the regulatory classification is decisive.

On the one hand, factoring is classified as a financial service pursuant to Section 1 (1a) No. 9 of the German Banking Act (Kreditwesengesetz “KWG”).

In addition, factoring is also classified as an acquisition transaction (Section 1 (1) sentence 2 no. 5 of the German Payment Services Supervision Act (Zahlungsdiensteaufsichtsgesetz “ZAG”) or as a financial transfer business (Section 1 (1) sentence 2 no. 6 ZAG).

BaFin assumes a payment service if, from an economic point of view, the service is aimed at payment processing and not at financing the contractual partner. In this case, the factoring company requires a factoring licence according to the ZAG.

If, on the other hand, the financing function is in the foreground, a factoring licence according to the KWG is required. (Anyone interested in more details should have a look at my blog post from 4 June 2019: https://paytechlaw.com/factoring-erlaubnis/.)

Who is an obliged entity under the German Anti-Money Laundering Act?

Obliged entities (Verpflichtete) according to the German Anti-Money Laundering Act (Geldwäschegesetz “GwG”) are listed in Section 2 (1) no. 1 to no. 16 GwG. According to Section 2 (1) no. 2 GwG, this includes financial service providers who operate factoring pursuant to Section 1 (1a) no. 9 KWG. Payment service providers who operate factoring as a payment service are also obligated entities under the GwG pursuant to Section 2 (1) no. 3 GwG. Therefore, it is irrelevant for the status as an obligated entitiy which type of factoring the factoring company operates.

The factoring company is subject to the following obligations under the GwG:

Preparation of a risk analysis (Section 5 GwG)

The factoring company must prepare a risk analysis showing what risks exist in its products with regard to money laundering.

In the risk analysis, the factoring company must particularly take into account the money laundering risk resulting from the three-person constellation. Therefore, the money laundering risk analysis must also consider characteristics of the end customers that are decisive in the two-person constellation when determining the risk with regard to the customer. This includes, for example, the countries in which the end customers are located and the industries to which they belong.

Establishment of internal security measures (Section 6 GwG)

Internal safeguards include the development of internal policies and procedures that define how money laundering risks are managed and how money laundering requirements are met.

The internal security measures must also be adapted to the factoring constellation. For example, a process must be set up to check whether the end customer or third parties are paying the Merchant Receivables.

Appointment of a money laundering reporting officer (Section 7 GwG)

The factoring company must appoint an AML-officer (Geldwäschebeauftragten). The AML-officer is responsible for ensuring compliance with anti-money laundering provisions. The AML-officer must have a minimum qualification, be appointed directly under the management and carry out his or her activities in Germany.

Identification of the contracting partner and its representative (Section 10 (1) no. GwG)

The factoring company must also fulfil the identification obligations under anti-money laundering law. According to the GwG, the obligated entitiy must identify its contractual partner and its representative when the business relationship (Geschäftsbeziehung) is established.

Who does the factoring company then need to identify?

The factoring company must first identify its customer, in this case the merchant, in terms of anti-money laundering law. The factoring company has established a business relationship with this client within the meaning of anti-money laundering law.

Does the factoring company also have to identify the end customer?

No, the end customer is not a contractual partner of the factoring company. There is no business relationship between the factoring company and the end customer. The factoring company only has a creditor position vis-à-vis the end customer. The underlying contractual relationship remains the purchase agreement between the merchant and the end customer, and it remains so even after the assignment of the Merchant Receivables to the factoring company. The assignment of the Merchant Receivables does not change this.

An obligation to identify the end customer may arise at most if the factoring company offers further services to the end customer which give rise to a separate contractual relationship with the end customer. In this case, the factoring company must also identify the end customer. Therefore, the factoring company must always ensure that it does not establish a business relationship with the end customer “by mistake”.

Clarification of the beneficial owners (Section 10 (1) no. 2 GwG)

Every obliged entity under the GwG the must identify the beneficial owners (Wirtschaftlich Berechtigte) of each contracting partner. A beneficial owner is any natural person (i) who ultimately owns or controls the contracting partner or (ii) at whose instigation a transaction is ultimately carried out or a business relationship is ultimately established.

Control is presumed if the natural person directly or indirectly holds 25% of the shares in the contracting partner or controls 25% of the voting rights.

As a rule, the factoring company only has to determine the merchant’s beneficial owners. In the case of special factoring constellations, on the other hand, it has to be checked whether the transaction underlying the factoring is carried out at the instigation of the end customer under certain circumstances.

Checking whether a politically exposed person (“PEP”) is involved (Section 10 (1) no. 4 GwG)

The obliged entity under the GwG must check whether the contracting partner or its beneficial owner is a PEP. To put it simply, a PEP is any person who holds a high political office. In the factoring constellation, the obligation in turn usually refers to the merchant.

In summary, it can be said that factoring companies are subject to all obligations under anti-money laundering law, but these must be adapted in detail to the special features of the three-person constellation in factoring.

Cover picture: Copyright © Adobe Stock / Comugnero Silvana