Crypto assets and e-money are very similar. Both are usually issued by private entities and serve as a means of payment. However, pursuant to the law, e-money does not constitute a crypto asset. So, how can they be distinguished? With that question in mind, here are some quick tips for your own analysis.

Table of Contents

Whenever an asset is stored digitally / electronically and it is issued by a private entity, this asset can fulfil the definition of e-money or that of a crypto asset. Doing business with either one requires a licence unless an exemption applies. However, the types of licence are different.

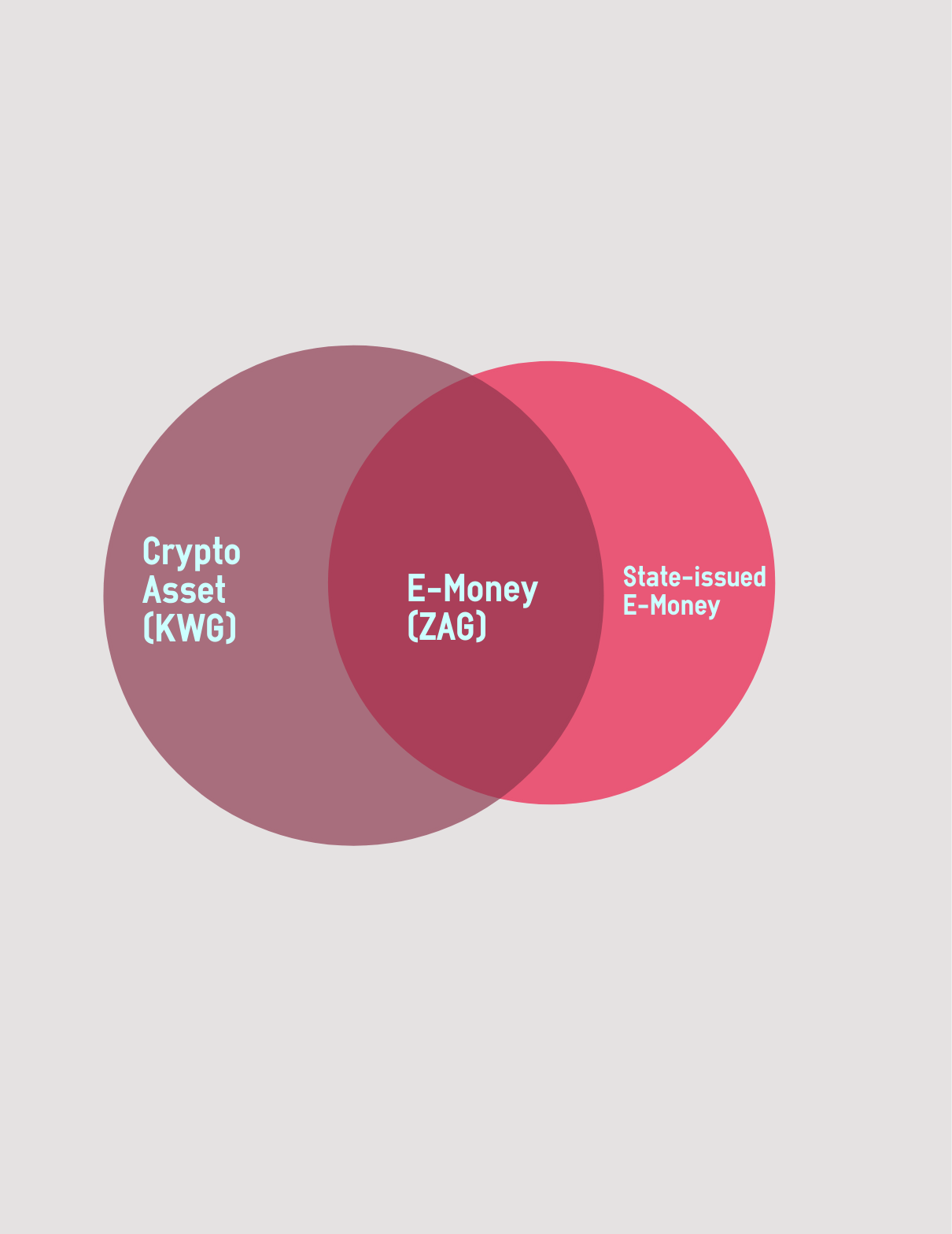

Some set theory with crypto assets and e-money

The definition of a crypto asset is much broader than that of e-money. Simply based on the definition, e-money would also constitute a crypto asset but it has been explicitly excluded from this definition by the legislator. Put in graphic form, it looks like this:

Quick tip: If something constitutes e-money, it is not a crypto asset.

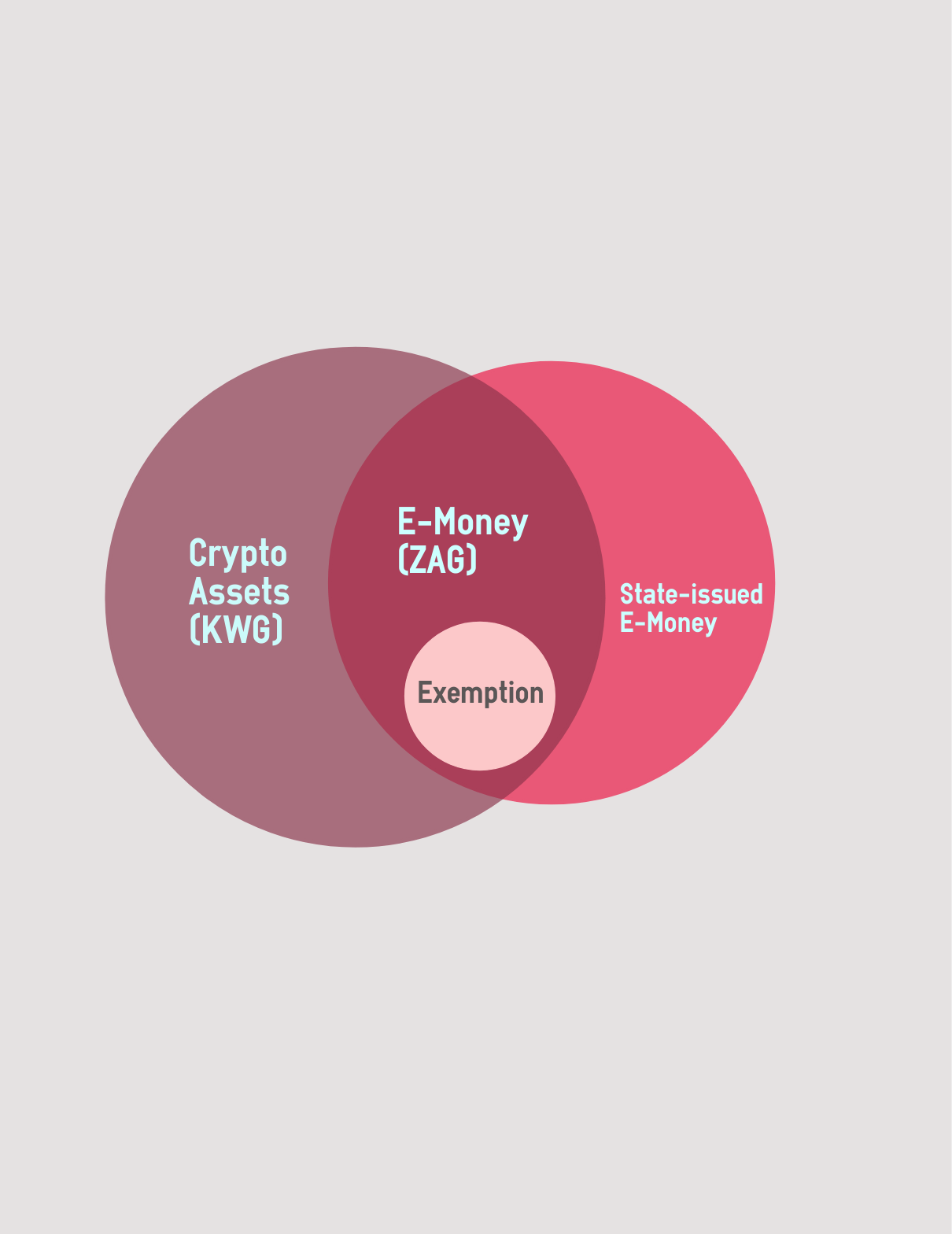

However, there are also vouchers that do not qualify as e-money as they fall under an exemption (Section 2 para. 1 no. 10 or no. 11 of the German Payment Services Supervision Act, ZAG). For example, this is the case with respect to vouchers that are based on one of the exemptions pursuant to Section 2 para. 1 no. 10 ZAG. By way of example, so-called city cards that are issued against money and that can be used for payment at different merchants in one city, would ordinarily fall under the definition of e-money. However, they do not constitute e-money as they fall under the exemption pursuant to Section 2 para. 1 no. 10 lit. a) ZAG (limited network). These exemptions have also been excluded from the legal definition of a crypto asset. In a graphic, it looks like this:

Quick tip: If something does not constitute e-money simply because if falls under an exemption, it is still not a crypto asset.

How are crypto assets and e-money created?

Both often have in common that the value is created through the acceptance of another value. For e-money, this can only be fiat currency or e-money. In other words, if the asset is issued in exchange for Bitcoin, financial instruments, property or other objects, it does not constitute e-money. However, it can constitute a crypto asset.

Quick tip: Only money and e-money can create e-money.

What can you do with crypto assets and e-money?

E-money has to serve as a means of payment. Crypto assets can also be used as a means of exchange or as an investment.

Quick tip: If something is not used as a means of payment, it is not e-money.

With regard to digital vouchers that can be redeemed against a good or service provided by the issuer, the following needs to be borne in mind: they do not constitute e-money as they are not accepted by third parties that are different from the issuer. However, they also do not constitute a crypto currency if the following applies: they cannot be traded, they only obtain an economic function when they are redeemed by the issuer and they do not trigger investor-like expectations. If you think this is slightly ambiguous, you are not alone. A utility token also embodies a right to a specific service that is only redeemed by the issuer. BaFin qualifies utility tokens as crypto assets. Does this mean that an iTunes voucher is a utility token? No. Numerous questions pertaining to interpretation are bound to arise in this area.

Quick tip: Digital vouchers and utility tokens are difficult to distinguish. If it is on a blockchain this can be a possible indicator.

Is everything on the blockchain a crypto asset?

Crypto assets are usually based on the distributed ledger technology. However, this is not a defining factor by law but only an indication. This is why it is always necessary to examine everything closely. A crypto asset could also be created as part of some software without the use of a blockchain. Blockchain-based e-money would also be possible as the definition of e-money does not include a reference to a certain technology being used.

The stress test: stable coins

Does a stable coin constitute a crypto asset? That is possible but not necessarily so. Stable coins often fulfil the definition of e-money. However, if, for example, a stable coin is also issued against other crypto currencies or other financial instruments and there is no central issuer and/or it does not serve as a means of payment, it constitutes a crypto currency. This shows that the differentiation is not that easy anymore and requires more analysis so that no quick tips that can help here.

Cover picture: Copyright © Adobe Stock / BillionPhotos.com