Did the pandemic affect the European card business?

In the first year of the new Corona era, the pandemic has shaken up consumer behaviour and thus payment habits in Europe. The demand for cash has increased, while its use as a means of payment has decreased. The volume of card payments (in euros) of cards issued in the EU-27 has declined slightly (minus 0.8% compared to 2019), despite the substitution of cash at the checkout and growth in e-commerce. However, the development is very heterogeneous within the EU in the member states, such as in Germany with plus 1.1% (incl. ELV) and in neighbouring Holland, by contrast, with minus 9.8%. The varying severity of the lockdowns has left its mark.

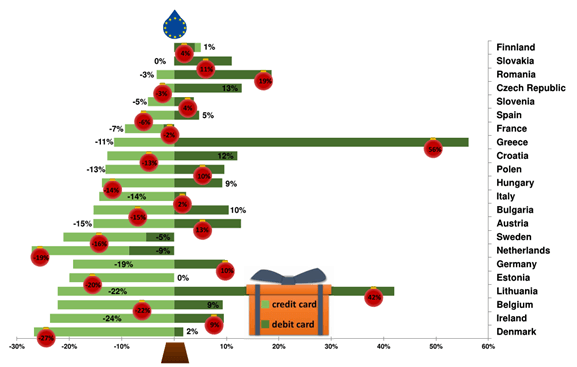

In the card business, however, it is noticeable that in almost all member states the credit card business (incl. so-called charge cards or delayed debit cards) has suffered considerably from the consequences of the pandemic: On average minus 13%. Obviously, the credit card continues to be the instrument preferred in the travel & entertainment segment and was particularly affected by the lockdowns. The debit card, on the other hand, was able to hold its own or even expand its position (at the expense of cash) with a growth of 4% in the payment of goods and services for daily needs. Obviously, not all cards are the same in the mind of the consumer.

The opposite development of debit and credit cards in the EU would theoretically lend itself to a nice pyramid-like graph. Our infographic is based on the ECB’s country statistics (data input by the respective central banks – as of July 2021). We have omitted some countries because there is no data for the card business there (Cyprus, Latvia, Malta) or apparently it is still not possible to distinguish between credit and debit cards, e.g. in Portugal. For Germany, we have added the ELV card volume (signature-based direct debits generated by using the domestic girocard) that is missing in the statistics.

Likewise, there is no added value in presenting the figures for Luxembourg, as the card sales volume recorded there is mainly generated by non-resident cardholders. The methodology of the ECB statistics is based on the location of the respective payment service provider. On the issuing side, it can still largely be assumed that the location of the card issuer and the cardholder are identical. Cross-border card issuing is still a relatively rare phenomenon (with the exception of Luxembourg and Lithuania).

To the infographic in PDF format: Infographic Corona and the European credit card business by Dr Hugo Godschalk from PaySys Consultancy

We have tried a lot, but somehow our Christmas tree has unsightly bare spots and some extremely long branches. What is going on?

In Lithuania, we have had the same problem since 2020 as described above for Luxembourg. As a result of the Brexit, some issuers from the UK have settled there, including the e-money institution Payrnet, which has taken over the card business of Wirecard Card Solutions. The card volume recorded so far in the UK is immediately significant in a relatively small member state (plus 42%). However, it has nothing to do with the Lithuanian card business, as most of this issuer’s cards are issued cross-border.

The second outlier is Greece with 56% (!) growth in debit card business. To curb tax evasion, the Greek government imposed card acceptance for most face-to-face transactions several years ago. Even the rent for a beach lounger can be paid by card almost everywhere. In addition, discounts in income tax were granted if one could prove cashless payments. At the time, this led to a jump in card sales statistics, but this effect has long since died down. To our knowledge, there are also no new coercive measures to encourage cashless (card) payments. A representative of a large Greek acquirer recently told me that card payments at POS in the face-to-face business have more or less stagnated in 2020. That doesn’t fit with the 56% increase in card payments on the issuing side unless Greeks made mass purchases with cards abroad and/or remote in the Corona year. The solution to the puzzle is probably a major error in the payment transaction statistics of the Bank of Greece. The statistics are inconsistent in several places. For example, in the same statistic, the number of POS transactions of Greek cards domestically and abroad in 2019 is given as 691 million, and elsewhere the number of only domestic POS transactions of these cards is given as 960 million. This does not add up. One or both numbers are wrong. A transposition of numbers? We have asked the central bank in Athens. The answer is still pending. We are pretty sure, this branch in our Christmas tree will soon be trimmed down considerably.

We’ll see what new insights the second Corona year brings us. Until then, we wish you a Merry Christmas, with a hopefully more beautiful Christmas tree.

Topic-related articles

German Central Bank payment transaction statistics: Can you solve these riddles?

Cover picture: Copyright © Adobe Stock/Jacob Lund