EU Regulation 2015/751 on interchange fees for card-based payment transactions – more commonly known as the Interchange Fee Regulation (IFR) – has probably been the most decisive regulation for payment transactions in the past decade. Not only did it impose limits for interchange fee payments from acquirers (payment services providers of the card-accepting merchants) to issuers (card issuers) with regard to consumer card payments (0.2% for debit cards and 0.3% for credit cards), Chapter III of the Regulation additionally contained a set of business rules which the European card business has had to adhere to since 9 June 2016.

Table of Contents

Some IF theory to start with

From an economic perspective, price regulations (though mainly well intended) despite existing competition in the market lead to distortion in the market. Either demand cannot be met (if price limits are imposed) or suppliers cannot sell their products (if minimum prices are imposed). It has to be said that an IF is not a “regular” market price but it is intended to balance external network effects in a so-called two-sided market. If the suppliers on the respective market side (that of payers and payees) can only generate profits from those market participants who have a direct need for their products, this pricing mechanism does not lead to the best results. Financial compensation to balance both market sides would result in a much better alignment of supply and demand.

There is another reason why interchange fees (IF) in card business do not constitute a “regular” price so far. The IF is not the result of numerous negotiations between various suppliers and the demand side but it is generally imposed in a “cartel”-like fashion by the currently mostly dominant issuer-side and it is set to be binding with respect to national or international markets. Antitrust authorities are probably not too pleased.

However, despite these anomalies, the payment instrument that is the “card” has become very widespread. Compared to direct debits and credit transfers, cards are by far the most commonly used payment instrument in Europe. Out of 272 cashless payments per inhabitant per year, 151 are made via card (2018).

The question whether it was card payment schemes or other IF-setters on their own account that determined the “optimum” price for the market in the time period before the EU Pricing Regulation (until the end of 2015), is of theoretical interest but somewhat complicated. In any case, with respect to the market result, the pricing commissioners of the schemes were not entirely wrong. Much more interesting is the question of whether the Commission’s pricing commissioners have improved or worsened the situation with the introduction of the IF limits (whose arbitrary levels are still awaiting post-regulatory justification).

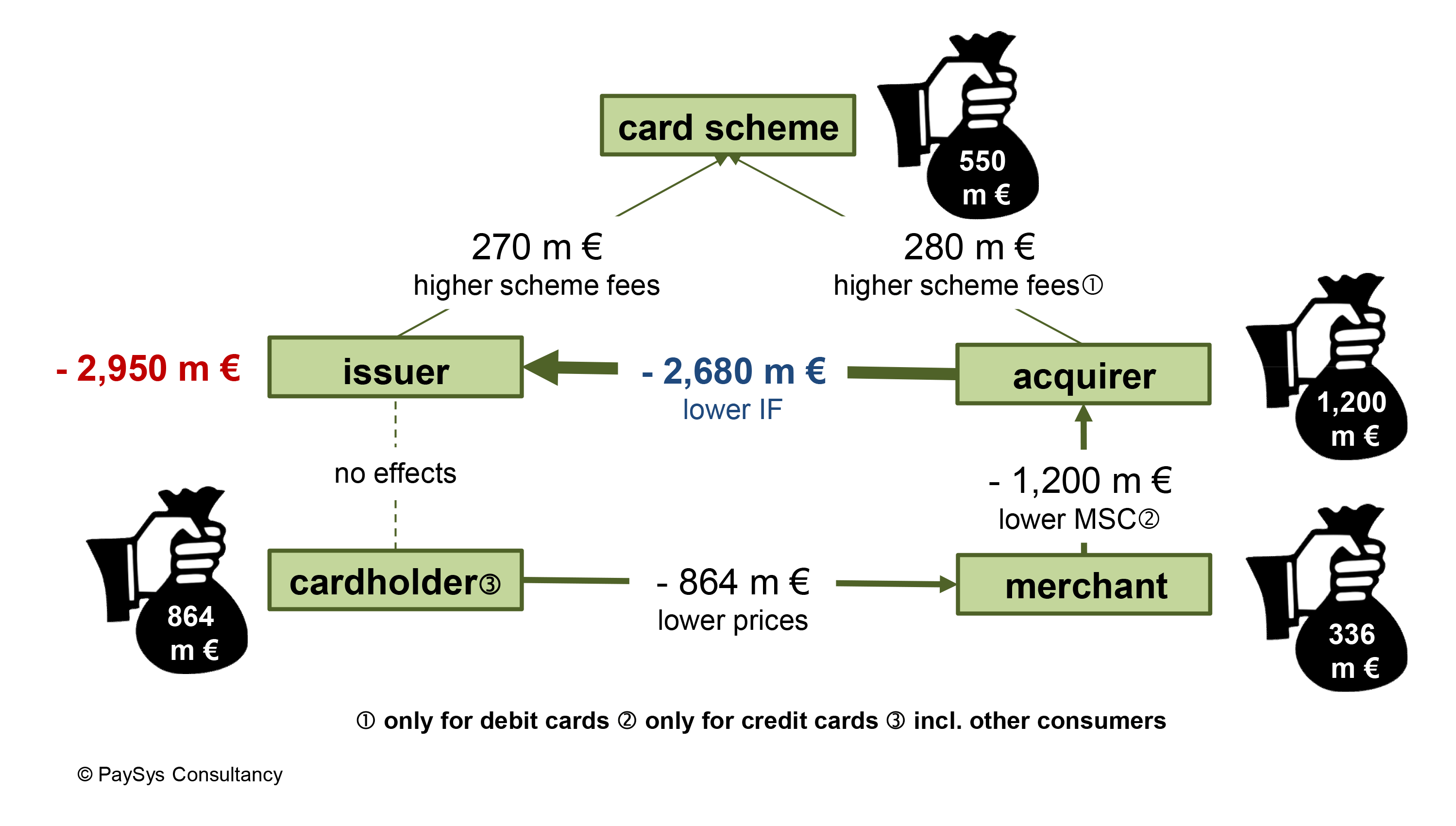

Redistribution of costs in the billions

In any case, the IF decrease imposed primarily led to a redistribution of cost in the billions between the suppliers on both market sides: a decrease in costs for acquirers and a loss of income for issuers. What are the secondary consequences for their customers? Have the issuers made up for their loss in income by increasing card fees? Have acquirers passed on their reduced costs to the merchants?

A redistribution of costs is a zero-sum game that naturally involves winners and losers. From the perspective of the European Commission, the aim was for consumers to benefit from the general price decreases imposed by the regulation. The theoretical chain of transmissions (“pass-through effect”) is simple: acquirers pass on their cost reductions to merchants by way of lower card acceptance fees. As a result, merchants lower their prices and the consumer benefits. This was the Commission’s idea, as can be read in the recitals of the Regulation. However, nothing can be found in there regarding the potential losers of the Regulation. If the consumer (who, at least statistically speaking, is also the card holder) gains the most from lower interchange fees as intended by the Commission, the only possible loser is the issuer. The Commission’s idea was based on the fact that the issuer cannot pass on its IF losses to the card users (consumers) by way of increased fees. The Commission apparently assumed implicitly that the issuers’ profits would easily absorb any losses or that the card business could be cross-subsidised by other banking business. So the goal of the journey was clear when the IFR entered into force but the path was paved with assumptions. What has become of the Commission’s daring blind flight?

The ignored EY/CE report

The final version of the “Study on the Application of the Interchange Fee Regulation” was published by Ernst & Young and Copenhagen Economics (EC) on 11 March on the Commission’s instructions. We already commented on a leaked draft version on 17 February in our partner “bargeldlosblog” by Hanno Bender. However, the final version significantly differs from the previous version.

The EY/CE analysis forms the basis for the Commission’s review report that was recently published on 29 June. It was then announced by Brussels that the Commission will not amend the IFR (“IFR2”).

Despite the significance of the IFR for card business, it went relativity under-reported in the (trade) press. Was this due to the Corona lockdown which took place at the same time? This comprehensive study (324 pages) would have made an excellent read while working from home. Or was it due to the results that fell flat and failed to knock anyone’s socks off?

The study’s central find is already of some significance. The IF decrease for the entire EU is “only” 2.7 billion. This is the result of the difference between the average IF amount for debit and credit card payments from the pre-IFR period (2015) and the post-IFR period (2017), multiplied by the EU card payment volume in 2015. The IF decreases in Germany, the UK and Italy have mainly contributed to this. As the IF upper limits have particularly affected credit cards, it is not surprising that these cards have added 1.9 billion euros to the result.

Back in the day when the draft of the planned IFR was published (2013), the Commission’s estimation was a whopping 6 billion euros (on the basis of the volumes generated in 2011 and the amounts from 2013). If the Commission’s estimations were applied to the same volume as the EY/CE study (2015), the result would be around 8 billion euros (instead of 2.7 billion). How can anyone get this so wrong? The Commission’s estimations already had to be taken with a pinch of salt back then due to numerous errors. For example, with respect to debit cards, it was not the lower amounts of the respective domestic card systems which were taken into consideration. Another reason for the discrepancy is the fact that in some countries the domestic IF had already been partially decreased prior to the IFR in 2014-2015 for cards that were part of international schemes (Mastercard and Visa)

Winners

In light of this, let’s concentrate for now on the 2.7 billion euros that were moved to the issuer-side of the market in order to ease the pressure on the acquirer-side. No doubt the acquirers were very happy about this windfall in profits. However, according to the EY/CE analysis, the acquirers only passed on slightly less than half (1.2 billion euros) to the merchants by way of lower card acceptancy fees (according to EY/CE only for credit cards). They must also have been happy about this semi-fair sharing of the profits. If and how much the merchants have passed on to consumers through price reductions, is a difficult question to answer. Analysts have only been able to estimate by referencing empirical data and model analyses from some countries and then use this data to make projections for the whole of the EU. This prediction estimated that around 0.9 billion euros of the originally 2.7 billion euros would be passed on to the consumer. This means ca. 1.70 euros per EU citizen. Not much is known yet about how happy they all were about this. In any case, according to EY/CE, the acquirers are the big winners from the IFR. They have to pay higher scheme fees for the card schemes (note bene: it appears that this only applies to debit cards!) but they retain a net benefit of 1.2 billion euros.

Losers

Now let’s look at the biggest loser. Card issuers do not have much to be happy about. They are being squeezed in two ways: their IF income is decreased by 2.7 billion euros and additionally, they have to pay 270 million euros in scheme fees. It appears that they were unable to adjust the fees for its card holders or save costs with the cards (e.g. halving the bonus points). Some card holders may object to this. Most likely a typical case of cognitive bias, such as the allegedly non-existent but perceived inflation after the introduction of the euro.

The naked Commission

Was the IFR at the end of the day only an issuer-financed stimulus package for acquirers? This result would, of course, leave the Commission looking pretty exposed.

But there are some clothes it can quickly put on.

First, the amount of the decrease in IF as calculated (2.7 billion euros) is too high and therefore also all secondary pass-through effects. The EY/CE analysists multiply the average IF decreases they have found for debit and credit cards with the entire card payment volume taken from the ECB statistics which amounts to ca. 2,851 billion euros (based on 2015). These statistics still contain the monumental mistake that was made regarding the English card volumes that contain ATM withdrawals amounting to 260 billion euros. It is hard to believe but this annoying mistake is still included. ECB: please correct! Furthermore, all card payments to which the IFR upper limits do not apply need to be deducted: i.e. corporate cards, three-party systems and inter-regional card payments. Subsequently, all card payments based on e-money need to be added again (EY/CE and Commission erroneously assume that these card payments are not subject to the IFR). If you use the correct figures for the multiplication, the amount of the IF cost redistribution decreases from 2.7 billion to ca. 1.8 billion euros. A detailed analysis can be found in our current PaySys Report No. 3-4.

Secondly, there is another investigation regarding the economic impact of the IFR that results, in parts, in completely different results. Already back in January 2020, management consultants Edgar, Dunn & Company (EDC) were commissioned by Mastercard to publish their analysis of the impact of the IFR (“Interchange Fee Regulation (IFR) Impact Assessment Study”). This analysis compared 2018 (post-IFR) with 2014 (pre-IFR) and also took into account quantitative effects (higher card volumes in 2018 compared to 2014). Below are some of the results that contradict the EY/CE study:

- Issuers were able to offset some of their IF losses by introducing higher card fees and reducing their loyalty programmes,

- Scheme fees did not rise but in fact decrease (!) per transaction,

- They could not find any evidence of decreases in costs being passed om from merchants to consumers.

Unlike the EY/CE study, the EDC analysis also takes into account the change in turnover generated by the current account business as well as loans taken out via credit cards. This leads to an unexpected result. Banks were able to overcompensate by 8.3 billion euros for their IF losses (amounting to 5.2 billion euros), particularly through interest and overdraft payments (6.6 billion) as well as revolving credits (1.7 billion). This begs the question as to what the connection is between overdrafts and the decrease in IF. Additionally, in the time period under consideration, interest payments from overdrafts are on the decline, at least in the euro-zone.

If one disregards any quantitative effects (increase in card transactions) and applies the IF decrease (2018 v. 2014) as suggested by EDC in accordance with the EY/CE study to the same card volume (2015), the IF decrease amounts to ca. 9 billion. So, what is correct:

- 7 billion euros (adjusted figure 1.8 billion euros) according to EY/CE (2017 v. 2015) or

- 9 billion euros according to EDC (2018 v. 2014)?

It is very difficult to reconcile these two results unless one assumes that the largest IF decrease already took place before the IFR 2015.

Economists are just like lawyers

It is said that if you ask two lawyers for their opinion, you get three different answers. This should not happen with economists if both work on the basis of the same figures. Or is the discrepancy due to the principal (European Commission or Mastercard)? Asking this would of course be nothing short of heresy.

As was to be expected, in its final report, the Commission only partially relies on the questionable results of the EY/CE study.

Last but not least, the interesting question remains as to whether the price regulation (which was done blindly) improved or negatively affected the market result based on card volumes. This is not looked into by either study. The fact is that card volumes in the EU have increased significantly since the IFR (as was also the case in the pre-IFR period). What was the impact of the Regulation on this? This is a question I would like to discuss in more detail in one of the next posts on this blog.

Cover picture: Copyright © Adobe Stock / OpturaDesign