Would you like to play a little guessing game? Yes? Great! The question to be answered is: What does the EU market for payment service providers have in common with the Eurovision Song Contest? Do you give up? No problem. That is what we are here for. And EUCLID, the little helper regarding the distribution of e-money and payment institutions in the EU.

Advanced maths or: the EBA register for e-money and payment institutions

Let’s start with something simple: The PSD2 has not only provided us with many new abbreviations such as SCA, PIS or AIS, but also with EUCLID. For those of you who recognised this name as the Greek mathematician: very impressive; you must have enjoyed a very good classical education! However, this is not about maths, but about the new EBA register for the distribution of e-money and payment institutions in the EU. EUCLID lists all e-money and payment institutions in the European Economic Area (EEA). Strictly speaking it is not all of them, but almost all of them, as we have already discovered that at least one is missing (long story, short – it’s ReiseBank AG). In any case, we owe this register to the PSD2. And the name given to this register by the EBA is EUCLID.

This fact alone would not have been worth a blog post. The much more interesting question is what information EUCLID can provide us with. For the first time, this register enables us to search in a reasonably conveniently way for all companies in the EEA that have obtained a licence as an e-money or payment institution. EUCLID also contains some additional information but we have decided not to concentrate on this for the purposes of this blog post.

The distribution of e-money and payment institutions in the EU: significant differences in the distribution of payment licences

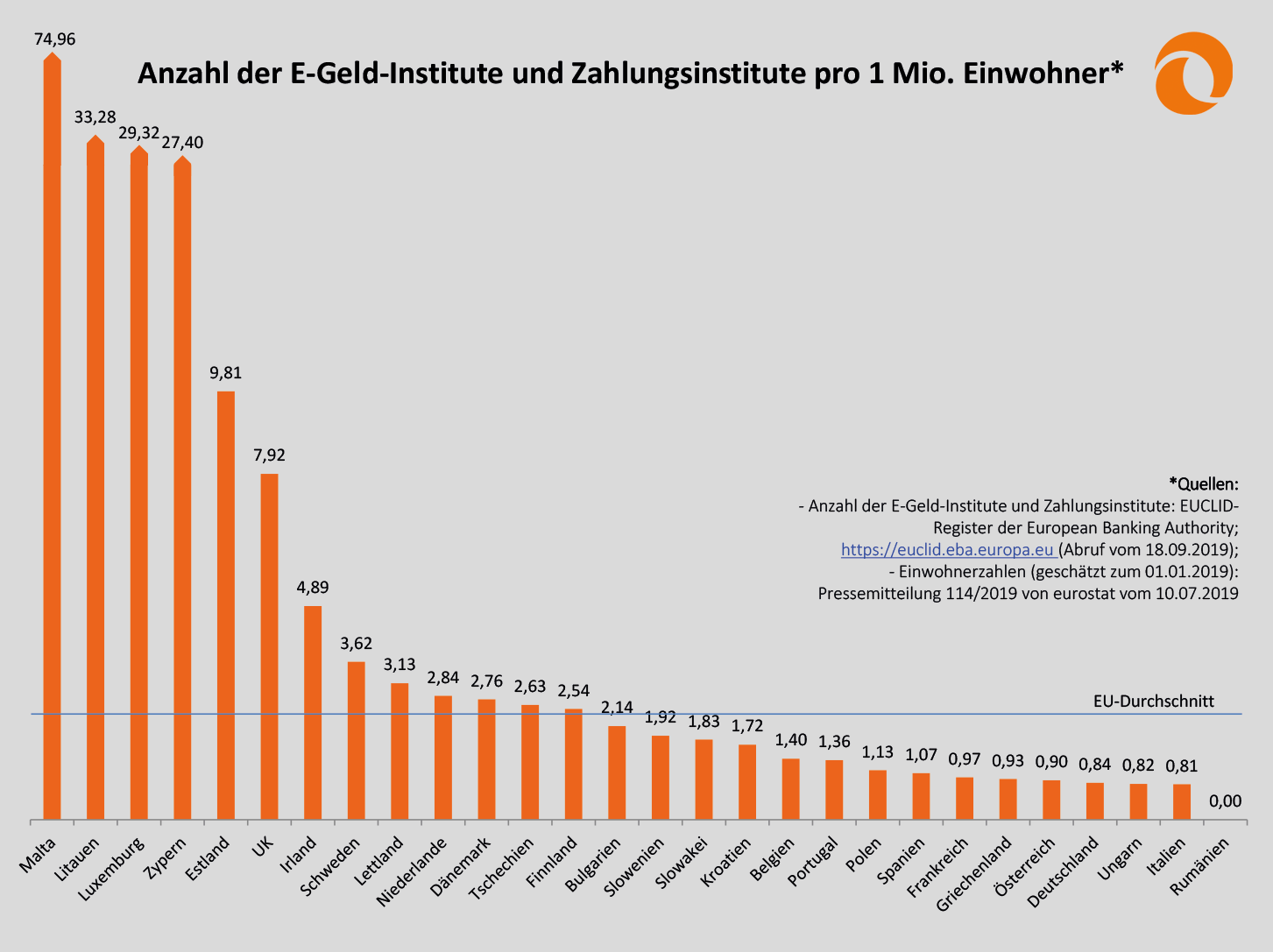

We have gone to the trouble of analysing how many e-money and payment institutions there are in the individual EU states. For the sake of simplicity, we have added these two values as we believe that, at least in quite a few cases, e-money institutions mainly provide payment services. And as we have already learnt, countries are of different sizes and therefore we cannot simply compare the absolute values. Therefore we have adjusted the figures from our analysis with regard to the respective number of inhabitants in each country.

The result of our analysis is an overview of the number of e-money and payment institutions per 1 million inhabitants.

We find the results to be very interesting. E-money and payment institutions appear to prefer smaller countries and island states such as Malta, Lithuania, Luxembourg or Cyprus. Malta, for example, has almost 100 times as many payment licences per 1 million inhabitants as Germany. Great Britain is also doing very well, despite the imminent Brexit. All in all, however, the question arises as to whether the single market has already been established for payment transactions. In light of the figures from our analysis, there is a serious question mark over this.

Germany left behind in the last group

In Germany, a licence as an e-money or payment institution does not appear to be particularly popular. According to our analysis, which we based on the figures available from EUCLID and eurostat, Germany only comes in at number 25 in the EU, ahead of only Hungary, Italy and Romania. The attentive among you will now hopefully be able to answer my introductory question. Do you remember? It was “What does the EU market for payment service providers have in common with the Eurovision Song Contest?” The correct answer is: at the last Eurovision Song Contest, Germany also came in 25th with the band “S!sters” and their song “Sister”.

So, don’t ever say PayTechLaw doesn’t teach you anything. 🙂

Cover picture: Copyright © fotolia /LVI