We have finally digested the roast, scoffed all the tasty biscuits and properly disposed of the wrapping paper in the recycling paper bin (or burnt it somewhere). After all this (hopefully) wonderful family time, we now have time again to take a look back at the year. As I already mentioned, our PayTechLaw team can be proud of on an eventful, successful and interesting 2018. We never dared hope that our blog would develop so well and be met by you with such interest and commitment (well, we always believed in it… 🙂 ). I have summarised below which topics were of particular interest to you in the PayTechLaw year 2018. So, without further ado, I present to you the PayTechLaw Top10 – 2018 (links in the headlines). Enjoy!

PayTechLaw Top10 – 2018

The EU General Data Protection Regulation was omnipresent in 2018. Companies had until 25 May 2018 to implement the GDPR. This also includes concepts for storing and, above all, deleting personal data. It is therefore no wonder that you showed such an interest in this topic. In his blog post, Udo describes the key steps companies have to take in order to create a deletion concept and the documentation related thereto to make it GDPR compliant.

The German version of “The deletion policies under the GDRP” was by far the most popular blog post on PayTechLaw in 2018. A close second was the English version of the blog post. This does not come as a great surprise as the GDPR is not a German but a pan-European topic.

See above. 🙂

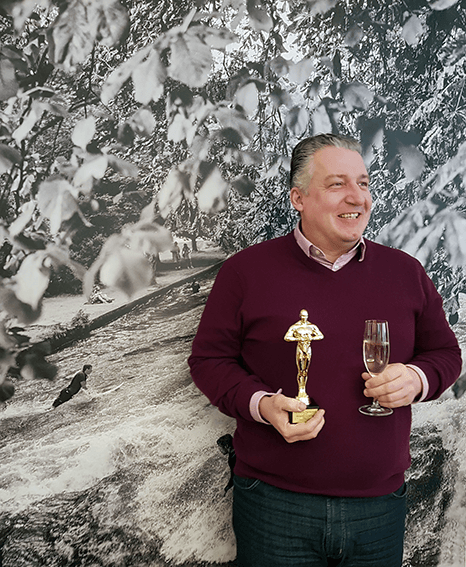

No wonder that Udo was awarded the PayTechLaw Oscar for being in the top three a record number of times in our internal weekly award ceremony “PayTechTop3”. We are already considering publicly announcing our weekly winners next year…

First, second and third place in our Top10 go to Udo: The deadline for implementing the Trade Secrets Directive had barely expired when he already addressed the issue. This is due to the fact that the German legislator has so far only presented a draft of a trade secrets law (GeschGehG-E) for the necessary implementation law, which is controversial in parts. Until the GeschGehG is adopted, the Trade Secrets Directive is therefore directly applicable. In his blog post, Udo shows which changes companies will have to make and what needs to be done to protect their own trade secrets in the future.

The devil is in the detail… Even after one year, the topics of “Payment Initiation Services” and “Account Information Services” are still very current. One of the most frequently discussed changes which PSD2 introduced to the European payment rules was the introduction of two new payment services: Payment Initiation Services (“PIS”) and Account Information Services (“AIS”). In her blog post, Susanne explains what this actually means.

It is an impressive feat that the five most popular entries came from only two of our PayTechLaw authors. In fifth place of our Top10, we once again have Susanne, who looked into the topic of “surcharging” in February this year. In her blog post, she presents “surcharging” once again in a coherent way and explains what is contained in the new § 270a BGB of the German Civil Code and highlights the many questions which still remain unanswered.

The sixth most popular article describes the current status of the implementation of PSD2 in Europe. The data presented here is based on information received from our esteemed European colleagues from the FinTech Lawyers Network. Here, you will also find further information on our network members. It is definitely worth taking a look.

Those who thought that the introduction of the revised Anti-Money Laundering Act to implement the Fourth Anti-Money Laundering Directive would result in a quieter time in terms of money laundering prevention were mistaken. The payment and FinTech industry has to prepare for a further tightening of anti-money laundering laws as envisaged by the Fifth Anti-Money Laundering Directive (AML5). The changes regarding e-money and cryptocurrencies are likely to be of particular interest for the payment and FinTech industry. In his contribution, Matthäus looks into the 5th Anti-Money Laundering Directive and explains the changes it introduces regarding e-money and cryptocurrencies.

Do you also sometimes get the feeling that you are losing track of everything in this jungle of laws? Do you provide payment services or issue e-money? Then we have something for you. In May, Christian published his infographics in which he compiled the essential laws that payment and e-money institutions should know. It comes as no surprise to me that one of Christian’s infographics, which are always very clear, can be found among the ten most popular entries from 2018.

The “intra-group exemption” can be found in Art. 3 lit. (n) PSD2. Simply put, it means that payment transactions within a group of companies do not fall within the scope of PSD2. The German Payments Services Supervisory Act (“ZAG”) sets out the same in Sec. 2 para. 1 No. 13 ZAG (i.e. the new ZAG effective from 13 January 2017, before in Sec. 1 para. 10 No. 13 ZAG), which stipulates that payment transactions and related services within a group of companies are not deemed payment services. According to the legislative notes, the exemption may be applied only to groups that are headed by a parent undertaking having one or more subsidiaries. Horizontal group companies that lack one common parent undertaking are excluded from the exemption. In her article from December 2017, Susanne explains what this means for the future.

The fourth part of his Bitcoin series has made it into the top 10 of the most popular blog posts of the PayTechLaw year 2018. In his post, Steffen looks into the topic of the “VAT treatment of Bitcoin and other cryptocurrencies”. One of the reasons for this entry was a letter from the German Federal Ministry of Finance (BMF), which was binding for all tax authorities in Germany, on the VAT treatment of Bitcoin and other so-called cryptocurrencies.

This was the top 10 of the most popular blog posts in 2018 – they cover a broad range of legal and regulatory topics regarding payment, banking, tax and IT. Thank you all very much for your interest in our content so far and congratulations to Susanne, Udo, Matthäus and Steffen for their popular posts! Keep it up!

If you want to know, which five episodes of PayTechTalk were most popular with you in 2018, visit us again the day after tomorrow, when we will publish PayTechTalk Top5, our most popular podcasts of 2018.

Until then – have another piece of Stollen! Cheers. 🙂

Cover picture: Copyright © PayTechLaw