The mysticism of numbers

There is a bon mot attributed to Bismarck: “Laws are like sausages, it is better not to be there when they are made. “One could add official statistics and other figures alongside sausages and laws. In cashless payment transactions, where every payment is meticulously registered, mysteries nevertheless open up. Today, three examples that I have encountered recently.

Table of Contents

The miraculous multiplication in Greece

Let’s start with the ECB’s official payment transaction statistics. Do you perhaps still remember my somewhat misguided Christmas tree as an infographic1 on the Corona effects in the European debit and credit card business at the end of 2021? In 2020, the virus had hit the credit card business in Europe in particular (-13%), while debit card sales (+4%) got off relatively lightly. Despite the decline in consumer spending, the debit card was able to hold its own by substituting cash. Greek debit cardholders, however, behaved extremely above average. In Corona year 1, their turnover increased by 56% without any discernible causes (such as any compulsory legal measures for card payments). At least in payment transactions, such jumps should light the warning lights in the statisticians’ heads. The cause of this statistical increase is obviously errors in the previous year’s figures for 2019, which are already demonstrably contradictory in themselves. A glance at the figures is enough.

After the incomplete Christmas tree was disposed of in January, I wrote to the statistics department of the Greek Central Bank. After all, they are legally obliged to provide the national data to the ECB. The answer from Athens came relatively quickly: yes, the figures are indeed contradictory. But there were problems with the data collection. The card market is relatively concentrated, which means that only a few payment service providers (including banks) supply 90% of the data. One incorrect entry already leads to considerable deviations in the overall result. Apparently, the beneficial effects of the law of large numbers are missing.

Will the data still be corrected? So far, the errors in Athens as well as in the Frankfurt ECB-tower are still official. The incorrect data from the Greek PSP even had to pass through two floodgates before being included in the ECB’s European statistics: The statistics department of the Greek Central Bank and that of the ECB. Simple plausibility checks by these departments would have been enough to discover the errors. The work of a statistician must involve more than just transferring figures in an Excel spreadsheet, right? Actually, one should be able to rely on official data.

The transaction shrinkage in Germany

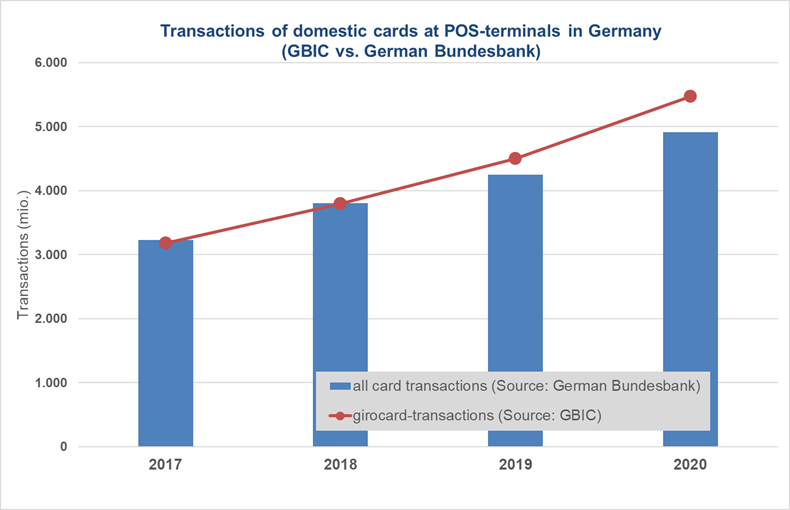

But there are also creative solutions to solve the problem of wrong data. That is my next case. It concerns a numerical puzzle of the Bundesbank payment transaction statistics2 , which was already discussed in 2021 in this blog3 , and which so far could not be solved by you as readers and also by me. The country statistics of the ECB and thus also of the Bundesbank have two perspectives: The issuer and the acquirer side of the card business and therefore also two sources. However, the results must not contradict each other. Now we have another source. Every year, the Deutsche Kreditwirtschaft (German Banking Industry Committee – GBIC) proudly publishes the figures for the girocard system. Based on the information provided by the girocard network operators, we can currently assume that these GBIC figures for girocard correspond to reality. In the past, there has also been some cheating (the sudden drop in turnover in 2015, which is recorded in the girocard statistics of the GBIC, never happened).

These figures refer to transactions at physical POS terminals in Germany (including some terminals in border areas, if applicable). Although this debit card is also used abroad via co-badging (Maestro, V PAY and now also Debit Mastercard), these transactions are not included. We can still neglect the few girocard transactions in e-commerce (cards of the savings banks via Apple Pay). For 2019, we had the problem that the additional girocard-turnover (compared to 2018) was about 23.6 billion euros according to GBIC, but the Bundesbank only recorded 8 billion additional turnover of all domestic cards (debit and credit) at POS terminals in Germany. This means that 15.6 billion girocard sales were missing. The contradiction cannot be solved, since the domestic cards with the international brands (Mastercard, Visa, etc.) also showed decent growth at the POS.

My suspicion at the time was that the turnover and transactions of domestic cards at domestic terminals reported by the Bundesbank (Table 6b and 7b) were far too low. For whatever reason. The suspicion is now confirmed in the new edition of the payment transaction statistics of July 2021 by a new footnote to this item: “Credit cards are partly not included due to technical circumstances.” This is a creative solution to the contradiction. Does this solve the problem?

Unfortunately, not. GBIC reports approx. 5.5 billion girocard transactions for 2020. The Bundesbank, on the other hand, reports only 4.9 billion transactions at domestic POS terminals with cards (debit and credit) issued by domestic banks (Tab. 6b). The footnote is of no help here, as the Bundesbank figure does not even include all girocard transactions. See graph. There was also a considerable difference for 2019. Moreover, in addition to the girocard, around 15 million debit cards with the Visa and Mastercard brands are issued in Germany, which are also used diligently at domestic terminals. There is a considerable lack of debit and credit card transactions. Instead of 4.9 billion, a figure somewhere between 6 and 6.5 billion would be realistic for 2020. I suggest that the footnote be changed: “A significant amount of card transactions are missing”.

But such a figure is completely useless. Imagine that the Federal Statistical Office publishes the current population figure but with the footnote “Residents in some large cities are not included“. What is one supposed to do with the published figure? If the missing major cities are not identical every year, not even the rate of change would have any insight value.

On the contrary, the publication of such figures is misleading, because who reads footnotes that are not even to be found directly near the respective table in the ECB’s country statistics, but in an additional file? Instead of any number, it is better to use the abbreviation n.i., where i stands for idea. Many other central banks in the EU act accordingly. There are many gaps in the ECB country statistics. Better no figure than presenting knowingly a clearly wrong figure.

Are privately produced figures better than the official ones? This leads us to the third case.

The Scheme Fees Black Box

The so-called scheme fees of the Mastercard and Visa card schemes continue to be a hot potato on the acquirer side of the European card business. Due to the European Interchange Fee Regulation (IFR-2015), the interchange fees (IF) for acquirers have been capped at 0.2% for debit cards and 0.3% for credit cards since 2015. Since 2017, on the other hand, the scheme fees that the acquirer has to pay have probably risen considerably in many Member States. This is particularly noticeable for merchants who settle with their acquirer on the basis of “unblended fees”: IF + scheme fees + fee for the acquirer service. Apparently – according to information from the merchant side – the reduction in IF has already been largely cancelled out by the increase in scheme fees. Merchant associations accuse the two card schemes of circumventing the IFR and have made representations to the European Commission. If necessary, these fees should also become the subject of future regulation.

(Side note: In the discussion, it is often overlooked that the scheme fees consist of two components: “real” scheme fees and fees of the schemes for processing services that do not have to be processed via the schemes. Regulation has made some of these processing services more expensive (e.g. due to the new requirements of strong customer authentication). The Commission would be the right address for merchant complaints, but also in its function as one of the drivers behind the the price increase.)

Looking for figures for Germany, I found them at the EuroCommerce trade association in a study published in December 20204 . According to data collected by the consultancy CMSPI, scheme fees for German card acceptance points of both schemes increased by over 60% in the period 2015-2019:

- Visa: + 2.5 basis points (from 0.038% to 0.063%)

- Mastercard: + 5.3 basis points (from 0.084% to 0.137%)

Based on the payment volumes of both schemes in 2019, this increase in scheme fees – according to CMSPI5 – leads to an additional annual burden for German merchants of €125.7 million.6 Surprisingly, the additional costs of €109.3 million are mainly attributable to Visa (Mastercard, by contrast, only €16.4 million), although the increase in basis points was twice as high for Mastercard (+5.3) compared to Visa (+2.5).

A healthy dose of scepticism and suspicion would be appropriate at the latest with this result. Mathematically, these figures lead to a huge payment volume (2019) of 437.2 billion euros for Visa. Compared to Visa, Mastercard disappears with 30.9 billion euros under “other”. Apart from these completely unrealistic market shares (Visa 94% vs. Mastercard 6%), the total volume of 468 billion euros (Visa + Mastercard) in Germany – assuming we are spared hyperinflation – will only be reached in the distant future (if at all). Instead of 468 billion euros, the payment volume of both schemes at German merchants amounted to approx. 106 billion euros in 2019. There has been little change in the size ratio for years: approx. 50%/50%. Currently, Visa is slightly ahead.

I do not know any plausible figures on the subject of scheme fees for Germany. Hard, reliable facts are missing. The Commission has now invited tenders for a study in May 2022 which, among other things, is to examine the development of scheme fees in several member states. The English regulator PSR7 also intends to conduct a new study. This is reasonable, because one cannot rely on the existing figures. Let’s see what comes out of it.

So what is the conclusion? According to Churchill: “The only statistics you can trust are the ones you have falsified yourself”? A healthy distrust is always reasonable. Often simple plausibility considerations are enough. In the case of “official” data, improved quality management would not be superfluous – at least in European payment statistics.

There are good sausages and laws, even if the production process was miserable. Numbers are not a matter of taste and do not have to be to everyone’s liking. The main thing is that numbers are correct.

[1] https://paytechlaw.com/en/infographic-corona-european-card-business/

[2] https://www.bundesbank.de/en/publications/statistics/statistical-series/statistical-series-statistics-on-payments-and-securites-trading-869892

[3] https://paytechlaw.com/en/payment-transaction-statistics-riddles/

[4] https://www.eurocommerce.eu/media/194481/CMSPI%20%20Zephyre%20-%20Scheme%20Fee%20Study%20final.pdf

[5] https://intern.hde.de/index.php?option=com_attachments&task=download&id=11082

[6] See also HDE, Zahlungsverkehr auf einer Seite (29 December 2020)

[7] https://www.psr.org.uk/news-updates/latest-news/news/psr-sets-out-the-details-for-its-work-on-card-fees/