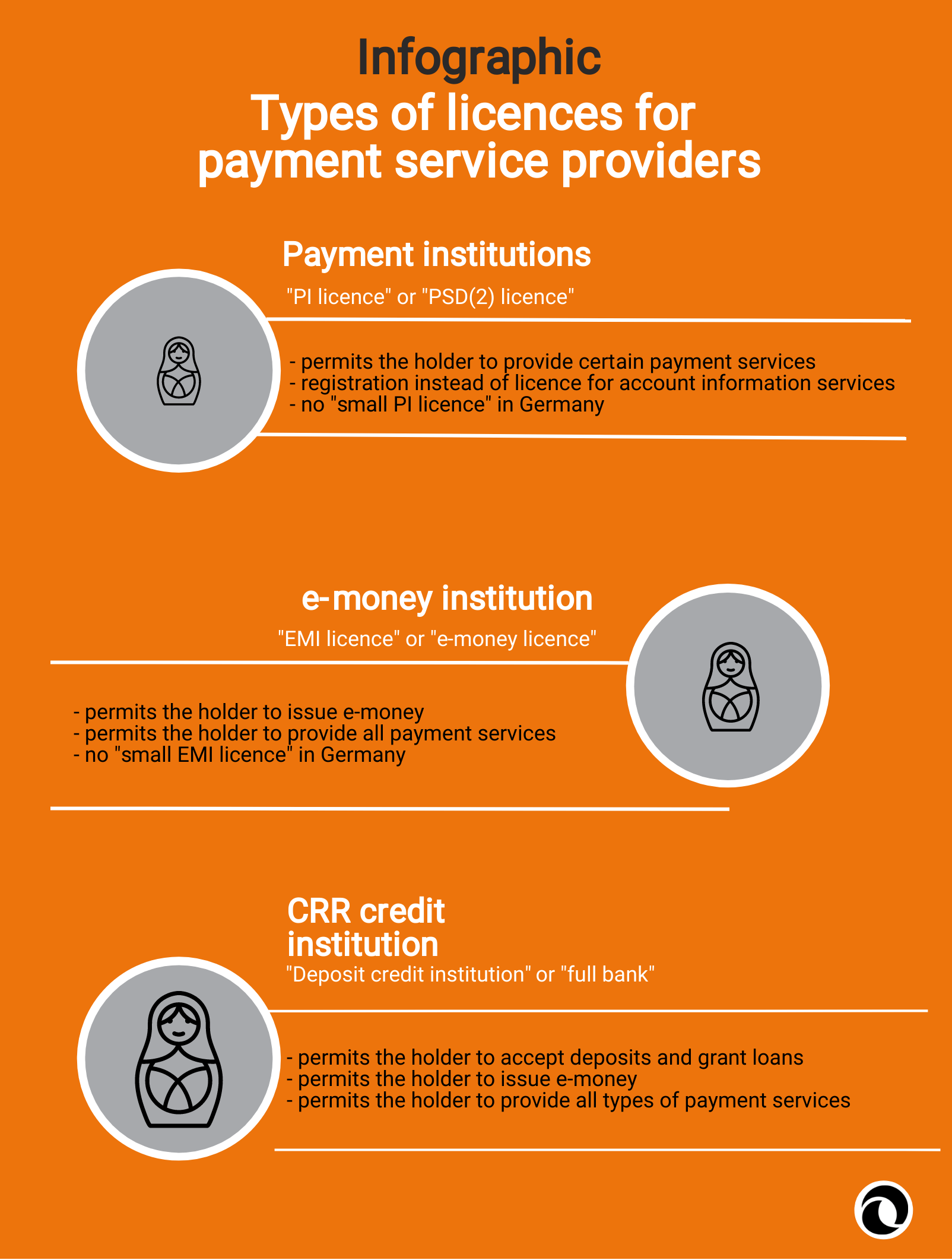

Perhaps you’ve experienced this before? When talking to different people about what licence is required for payment services, you get a multitude of different answers: some will tell you something about an e-money licence that you need. Others think that a “small PSD licence” is entirely sufficient. And others are of the opinion that you need to be a bank for everything to work. PayTechLaw helps you navigate this legal jungle and explains in this article what types of licences there are for payment service providers, what type of licence you need and when. For those who are not fond of reading or are short on time, we have also prepared a summary of this explanation by way of an infographic.

Small but great: payment institution licence or registration

Let’s start with the basics. You only want to provide a payment service and nothing else? Great. Then a licence as a payment institution will be sufficient for you. If you only want to provide account information services, a mere registration will suffice. The payment institution licence is governed by Section 10 of the German Payment Services Supervision Act (ZAG). The registration can be found in Section 34 ZAG. Please note: The payment institution licence only permits you to provide payment services which are expressly mentioned in the licence. If, for example, you only have a licence for payment initiation services but you also want to provide account information services in the future, you need to apply for an additional licence. The payment institution licence or registration is also known by other names. Some call it the “PI licence” – “PI” is short for “payment institutions”. Others refer to it as the “PSD[2] licence”, which refers to the EU Payment Services Directive on which the regulation of payment services is based. And others call it a “BaFin licence”. However, this term does not allow any conclusions to be drawn as to what type of licence it is, but only who has granted the licence.

The little sister of the payment institution licence or registration is the so-called “small PI licence”. In reality, this is not a licence at all but an exception. This exception allows a company to provide a very limited range of payment services exclusively in its home country. For Germany, this exception is of no relevance as the German legislator has decided against this exception.

If you are looking for some more: the licence as an e-money institution

If you do not simply want to provide payment services but also issue e-money, then a little more is required. In this case, you need a licence as an e-money institution. This licence is governed by Section 11 ZAG. A licence as an e-money institution not only allows you to issue e-money but also to provide all payment services. In other words, an e-money institution may automatically provide all types of payment services. The licence as an e-money institution is also sometimes known as an “e-money licence” or an “EMI licence”.

The licence for e-money institutions also has a little sister, which is called the “small EMI-licence”. As with the small PI licence, this is not a licence but an exception. This exception also only applies in the respective country of domicile of the relevant company and only to a very limited extent. This exception, too, does not play a role in Germany.

Think big: The licence as a CRR credit institution

If all of the above is not enough for you, you can obtain a licence as a CRR credit institution from the European Central Bank. This licence is governed by Section 32 of the German Banking Act (KWG) and Article 14 of Regulation (EU) No. 1024/2013. A CRR credit institution is authorised to provide all payment services and issue electronic money. It can also accept deposits and grant loans. The term CRR credit institution is relatively new, which is why the terms “deposit credit institution” or “full bank” are used more frequently. The term “banking licence”, which is often used, does not allow any conclusions to be drawn about whether the company holding such a licence is also a CRR credit institution. There are, therefore, also bank licences that do not allow the holder to provide payment services or issue e-money. If someone tells you that they have a banking licence, you should therefore find out which one exactly they have.

You cannot have it all: stocking up with licences is not possible

For those of you who are now determined to apply for a licence as a CRR credit institution, there is one thing you should know: BaFin only grants a licence for those activities which you specifically intend to perform. For example, if you are only planning to provide payment services, you will not receive a licence as an e-money institution or as a credit institution.

Cover picture: Copyright © fotolia_Jan Engel